GameStop 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

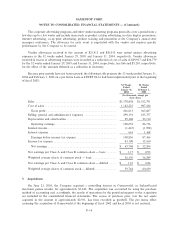

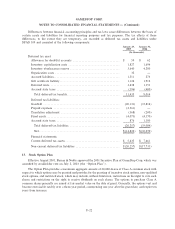

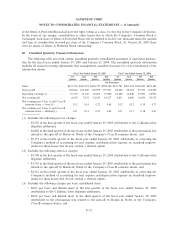

6. Accrued Liabilities

Accrued liabilities consist of the following:

January 29, January 31,

2005 2004

(In thousands)

Customer liabilities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $35,213 $26,797

Deferred revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,484 7,255

Accrued rent ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,090 7,378

Employee compensation and related taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,750 6,525

Other taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,129 5,033

Other accrued liabilitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 33,317 26,851

Total accrued liabilities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $94,983 $79,839

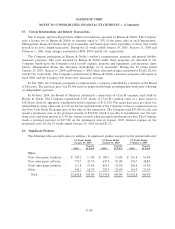

7. Goodwill

The Company adopted the transitional disclosures of SFAS 142 eÅective February 3, 2002 (see Note 1).

The changes in the carrying amount of goodwill for the Company's business segment for the 52 weeks ended

January 29, 2005 and January 31, 2004 were as follows:

Goodwill

(In thousands)

Balance at February 1, 2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $317,957

Addition for the acquisition of Gamesworld Group Limited ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,869

Impairment for the 52 weeks ended January 31, 2004ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì

Balance at January 31, 2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 320,826

Additional cost relating to the acquisition of Gamesworld Group Limited ÏÏÏÏÏÏÏÏ 62

Impairment for the 52 weeks ended January 29, 2005ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì

Balance at January 29, 2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $320,888

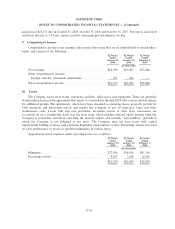

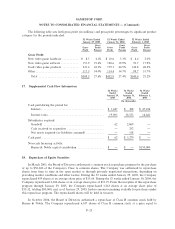

8. Debt

In June 2004, the Company amended and restated its $75,000 senior secured revolving credit facility,

which now expires in June 2009. The revolving credit facility is governed by an eligible inventory borrowing

base agreement, deÑned as 55% of non-defective inventory, net of certain reserves. Loans incurred under the

credit facility will be maintained from time to time, at the Company's option, as: (1) Prime Rate loans which

bear interest at the prime rate (deÑned in the credit facility as the higher of (a) the administrative agent's

announced prime rate, or (b)

1

/

2

of 1% in excess of the federal funds eÅective rate, each as in eÅect from time

to time); or (2) LIBO Rate loans bearing interest at the LIBO Rate for the applicable interest period, in each

case plus an applicable interest margin. In addition, the Company is required to pay a commitment fee,

currently 0.375%, for any unused amounts of the revolving credit facility. Any borrowings under the revolving

credit facility are secured by the assets of the Company. If availability under the revolving credit facility is less

than $20,000, the revolving credit facility restricts the Company's ability to pay dividends. There have been no

borrowings under the revolving credit facility.

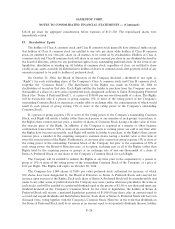

In October 2004, the Company issued a promissory note in favor of Barnes & Noble in the principal

amount of $74,020 in connection with the repurchase of Class B common shares held by Barnes & Noble. A

payment of $37,500 was made on January 15, 2005, as required by the promissory note, which also requires

F-18