GameStop 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

credit facility is less than $20.0 million, the revolving credit facility restricts our ability to pay dividends. There

have been no borrowings under the revolving credit facility.

In March 2003, the Board of Directors authorized a common stock repurchase program for the purchase

of up to $50.0 million of the Company's Class A common shares. The Company had the right to repurchase

shares from time to time in the open market or through privately negotiated transactions, depending on

prevailing market conditions and other factors. During the 52 weeks ended January 29, 2005, the Company

repurchased 959,000 shares at an average share price of $15.64. During the 52 weeks ended January 30, 2004,

the Company repurchased 2,304,000 shares at an average share price of $15.19. From the inception of this

repurchase program through January 29, 2005, the Company repurchased 3,263,000 shares at an average share

price of $15.32, totaling $50.0 million, and, as of January 29, 2005, had no amount remaining available for

purchases under this repurchase program. The repurchased shares will be held in treasury.

In October 2004, the Board of Directors authorized a repurchase of Class B common stock held by

Barnes & Noble. The Company repurchased 6,107,000 shares of Class B common stock at a price equal to

$18.26 per share for aggregate consideration of $111.5 million. The Company paid $37.5 million in cash and

issued a promissory note in the principal amount of $74.0 million. A payment of $37.5 million was made on

January 15, 2005, as deÑned in the promissory note, which also requires three payments of $12.2 million due

on October 15, 2005, October 15, 2006 and October 15, 2007. The note is unsecured and bears interest at

5.5% per annum, payable when principal installments are due. The repurchased shares were immediately

retired.

Based on our current operating plans, we believe that available cash balances and cash generated from

our operating activities will be suÇcient to fund our operations, required payments on our note payable, store

expansion and remodeling activities and corporate capital expenditure programs for at least the next

12 months.

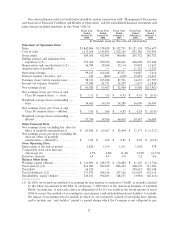

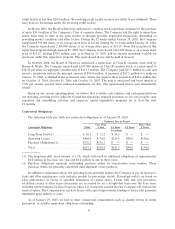

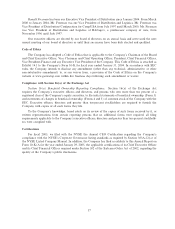

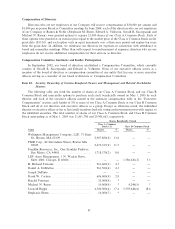

Contractual Obligations

The following table sets forth our contractual obligations as of January 29, 2005:

Payments Due by Period

Less Than More Than

Contractual Obligations Total 1 Year 1-3 Years 3-5 Years 5 Years

In millions

Long-Term Debt(1) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 36.5 $ 12.2 $ 24.3 $ Ì $ Ì

Operating Leases ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $444.4 $ 70.0 $120.9 $98.9 $154.6

Purchase Obligations(2) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $176.2 $176.2 $ Ì $ Ì $ Ì

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $657.1 $258.4 $145.2 $98.9 $154.6

(1) The long-term debt bears interest at 5.5%, which will result in additional obligations of approximately

$2.0 million in less than one year and $2.0 million in one to three years.

(2) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These

purchase orders are generally cancelable until shipment of the products.

In addition to minimum rentals, the operating leases generally require the Company to pay all insurance,

taxes and other maintenance costs and may provide for percentage rentals. Percentage rentals are based on

sales performance in excess of speciÑed minimums at various stores. Leases with step rent provisions,

escalation clauses or other lease concessions are accounted for on a straight-line basis over the lease term,

including renewal options for those leases in which it is reasonably assured that the Company will exercise the

renewal option. The Company does not have leases with capital improvement funding or leases with payments

dependent upon indexes or rates.

As of January 29, 2005, we had no other commercial commitments such as standby letters of credit,

guarantees, or standby repurchase obligations outstanding.

31