GameStop 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

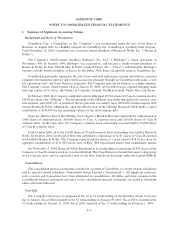

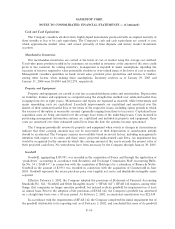

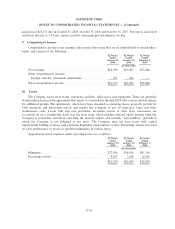

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

was impaired. As part of this analysis, the Company determined that it has one reporting unit based upon the

similar economic characteristics of its operations. Fair value of this reporting unit was estimated using market

capitalization methodologies. Subsequent to the acquisition of Gamesworld, the Company determined that it

still has one reporting unit based upon the similar economic characteristics of its operations. The Company

also evaluates the goodwill of its reporting unit for impairment at least annually, which the Company has

elected to perform during the fourth quarter of each Ñscal year. For Ñscal 2004 and 2003, the Company

determined that none of its goodwill was impaired. Note 7 provides additional information concerning

goodwill.

Revenue Recognition

Revenue from the sales of the Company's products is recognized at the time of sale. The sales of used

video game products are recorded at the retail price charged to the customer. Sales returns (which are not

signiÑcant) are recognized at the time returns are made.

Subscription and advertising revenues are recorded upon release of magazines for sale to consumers and

are stated net of sales discounts. Magazine subscription revenue is recognized on a straight-line basis over the

subscription period.

Customer Liabilities

The Company establishes a liability upon the issuance of merchandise credits and the sale of gift cards.

Revenue is subsequently recognized when the credits and gift cards are redeemed. In addition, income

(""breakage'') is recognized quarterly on unused customer liabilities older than three years to the extent that

the Company believes the likelihood of redemption by the customer is remote, based on historical redemption

patterns. Breakage has historically been immaterial. To the extent that future redemption patterns diÅer from

those historically experienced, there will be variations in the recorded breakage.

Pre-Opening Expenses

All costs associated with the opening of new stores are expensed as incurred. Pre-opening expenses are

included in selling, general and administrative expenses in the accompanying consolidated statements of

operations.

Closed Store Expenses

Upon a formal decision to close or relocate a store, the Company charges unrecoverable costs to expense.

Such costs include the net book value of abandoned Ñxtures and leasehold improvements and a provision for

future lease obligations, net of expected sublease recoveries. Costs associated with store closings are included

in selling, general and administrative expenses in the accompanying consolidated statements of operations.

Advertising Expenses

The Company expenses advertising costs for newspapers and other media when the advertising takes

place. Advertising expenses for newspapers and other media during the 52 weeks ended January 29, 2005,

January 31, 2004 and February 1, 2003, were $8,881, $7,044 and $4,258, respectively.

Income Taxes

For the periods prior to the OÅering, GameStop was included in the consolidated federal tax return of

Barnes & Noble. Following the closing of the OÅering, Barnes & Noble owned less than 80% of GameStop

and, accordingly, was no longer permitted to consolidate GameStop's operations for income tax purposes.

Since the close of the OÅering, GameStop has Ñled income tax returns as a ""C'' corporation on a stand-alone

F-11