GameStop 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

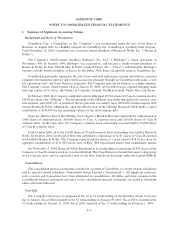

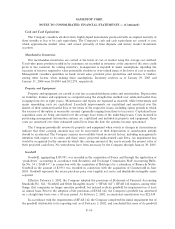

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Foreign Currency Translation

Gamestop has determined that the functional currency of its foreign subsidiary is the subsidiary's local

currency (the EURO). The assets and liabilities of the subsidiary are translated at the applicable exchange

rate as of the end of the balance sheet date and revenue and expenses are translated at an average rate over the

period. Currency translation adjustments are recorded as a component of other comprehensive income.

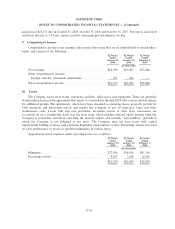

Net Earnings Per Common Share

Net earnings per Class A and Class B common share is presented in accordance with Statement of

Financial Accounting Standards No. 128, ""Earnings Per Share'' (""SFAS 128''). Basic earnings per Class A

and Class B common share is computed using the weighted average number of common shares outstanding

during the period and excludes any dilutive eÅects of the Company's outstanding options.

Diluted earnings per Class A and Class B common share is computed using the weighted average number

of common and dilutive common shares outstanding during the period. Note 4 provides additional information

regarding net earnings per common share.

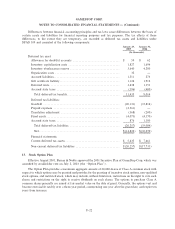

Stock Options

Statement of Financial Accounting Standards No. 123, ""Accounting for Stock Based Compensation,''

(""SFAS 123'') encourages but does not require companies to record compensation cost for stock based

employee compensation plans at fair value. As permitted under Statement of Financial Accounting Standards

No. 148, ""Accounting for Stock Based Compensation Ì Transition and Disclosure,'' (""SFAS 148'') which

amended SFAS 123, the Company has elected to continue to account for stock based compensation using the

intrinsic value method prescribed in Accounting Principles Board Opinion No. 25, ""Accounting for Stock

Issued to Employees,'' and related interpretations. Accordingly, compensation cost for stock options is

measured as the excess, if any, of the quoted market price of the Company's stock at the date of the grant over

the amount an employee must pay to acquire the stock. Note 13 provides additional information regarding the

Company's stock option plan.

F-13