GameStop 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.OÅ-Balance Sheet Arrangements

As of January 29, 2005, the Company had no oÅ-balance sheet arrangements as deÑned in Item 303 of

Regulation S-K.

Impact of InÖation

We do not believe that inÖation has had a material eÅect on our net sales or results of operations.

Certain Relationships and Related Transactions

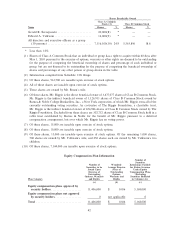

The Company operates departments within ten bookstores operated by Barnes & Noble. The Company

pays a license fee to Barnes & Noble in amounts equal to 7.0% of the gross sales of such departments.

Management deems the license fee to be reasonable and based upon terms equivalent to those that would

prevail in an arm's length transaction. During the 52 weeks ended January 29, 2005, January 31, 2004 and

February 1, 2003, these charges amounted to $0.9 million, $1.0 million and $1.1 million, respectively.

The Company participates in Barnes & Noble's worker's compensation, property and general liability

insurance programs. The costs incurred by Barnes & Noble under these programs are allocated to the

Company based upon the Company's total payroll expense, property and equipment, and insurance claim

history. Management deems the allocation methodology to be reasonable. During the 52 weeks ended

January 29, 2005, January 31, 2004 and February 1, 2003, these allocated charges amounted to $2.7 million,

$2.4 million and $1.7 million, respectively. The Company's participation in Barnes & Noble's insurance

programs will expire in Ñscal 2005 and the Company will secure new insurance coverage.

In July 2003, the Company purchased an airplane from a company controlled by a member of the Board

of Directors. The purchase price was $9.5 million and was negotiated through an independent third party

following an independent appraisal.

In October 2004, the Board of Directors authorized a repurchase of Class B common stock held by

Barnes & Noble. The Company repurchased 6,107,000 shares of Class B common stock at a price equal to

$18.26 per share for aggregate consideration of $111.5 million. The repurchase price per share was determined

by using a discount of 3.5% on the last reported trade of the Company's Class A common stock on the New

York Stock Exchange prior to the time of the transaction. The Company paid $37.5 million in cash and issued

a promissory note in the principal amount of $74.0 million, which is payable in installments over the next three

years and bears interest at 5.5% per annum, payable when principal installments are due. The Company made

a principal payment of $37.5 million on the promissory note in January 2005. Interest expense on the

promissory note for the 52 weeks ended January 29, 2005 totaled $1.3 million.

Recent Accounting Pronouncements

In December 2004, the FASB issued Statement of Financial Accounting Standard No. 123 (Revised

2004), Share-Based Payment, (""FAS 123(R)''). This Statement requires companies to expense the

estimated fair value of stock options and similar equity instruments issued to employees. Currently, companies

are required to calculate the estimated fair value of these share-based payments and can elect to either include

the estimated cost in earnings or disclose the pro forma eÅect in the footnotes to their Ñnancial statements. We

have chosen to disclose the pro forma eÅect. The fair value concepts were not changed signiÑcantly in

FAS 123(R), however, in adopting this Standard, companies must choose among alternative valuation models

and amortization assumptions. The valuation model and amortization assumption we have used continue to be

available, but we have not yet completed our assessment of the alternatives. FAS 123(R) will be eÅective for

the Company beginning with the third quarter of 2005. Transition options allow companies to choose whether

to adopt prospectively, restate results to the beginning of the year, or to restate prior periods with the amounts

on a basis consistent with pro forma amounts that have been included in their footnotes. We have not yet

concluded which transition option we will select. For the pro forma eÅect of a full year application, using our

existing valuation and amortization assumptions, see Note 1 of Notes to Consolidated Financial Statements

included in Item 15 of this Report on Form 10-K/A.

32