GameStop 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

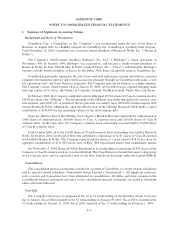

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

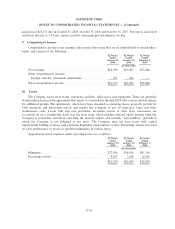

basis. Accordingly, the Ñnancial statements reÖect income tax expense as if GameStop had Ñled separate

income tax returns as a ""C'' corporation on a stand-alone basis. The Company accounts for income taxes in

accordance with the provisions of Statement of Financial Accounting Standards No. 109 ""Accounting for

Income Taxes'' (""SFAS 109''). SFAS 109 utilizes an asset and liability approach, and deferred taxes are

determined based on the estimated future tax eÅect of diÅerences between the Ñnancial reporting and tax

bases of assets and liabilities using enacted tax rates.

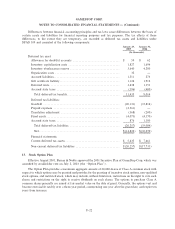

Lease Accounting

The Company, similar to many other retailers, has revised its method of accounting for rent expense (and

related deferred rent liability) and leasehold improvements funded by landlord incentives for allowances under

operating leases (tenant improvement allowances) to conform to generally accepted accounting principles

(""GAAP''), as recently clariÑed by the Chief Accountant of the SEC in a February 7, 2005 letter to the

American Institute of CertiÑed Public Accountants. For all stores opened since the beginning of Ñscal 2002,

the Company had calculated straight-line rent expense using the initial lease term, but was generally

depreciating leasehold improvements over the shorter of their estimated useful lives or the initial lease term

plus the option periods. The Company corrected its calculation of straight-line rent expense to include the

impact of escalating rents for periods in which it is reasonably assured of exercising lease options and to

include in the lease term any period during which the Company is not obligated to pay rent while the store is

being constructed (""rent holiday''). The Company also corrected its calculation of depreciation expense for

leasehold improvements for those leases which do not include an option period. Because the eÅects of the

correction were not material to any previous years, a non-cash, after-tax adjustment of $3,312 was made in the

fourth quarter of Ñscal 2004 to correct the method of accounting for rent expense (and related deferred rent

liability). Of the $3,312 after-tax adjustment, $1,761 pertained to the accounting for rent holidays, $1,404

pertained to the calculation of straight-line rent expense to include the impact of escalating rents for periods in

which the Company is reasonably assured of exercising lease options and $147 pertained to the calculation of

depreciation expense for leasehold improvements for the small portion of leases which do not include an option

period. The aggregate eÅect of these corrections relating to prior years was $1,929 ($948 for Ñscal 2003, $397

for Ñscal 2002 and $584 for years prior to Ñscal 2002). The correction does not aÅect historical or future cash

Öows or the timing of payments under related leases.

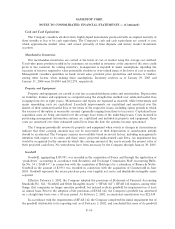

In addition, the Company has changed its classiÑcation of tenant improvement allowances on its balance

sheets and statements of cash Öows. Like many other retailers, the Company had historically classiÑed tenant

improvement allowances as reductions of property and equipment on the Company's balance sheets, as

reductions in depreciation and amortization in the Company's statements of operations and as reductions in

capital expenditures, an investing activity, on the Company's statements of cash Öows. In order to comply with

the provisions of FASB Technical Bulletin No. 88-1, ""Issues Relating to Accounting for Leases''

(""FTB 88-1''), however, the Company has reclassiÑed tenant improvement allowances as deferred rent

liabilities (in long-term liabilities) on the Company's balance sheets, as a reduction of rent expense (in selling,

general and administrative expenses) in the statements of operations and as an operating activity on the

statements of cash Öows. The eÅect of this reclassiÑcation increased property and equipment and deferred rent

and other long-term liabilities on the Company's balance sheets by $4,671 as of January 29, 2005 and $3,265

as of January 31, 2004, decreased selling, general and administrative expense and increased depreciation

expense in the Company's statements of operations by $671, $540 and $601 in Ñscal 2004, 2003 and 2002,

respectively, and increased net cash Öows provided by operating activities and increased net cash Öows used in

investing activities in the Company's statements of cash Öows by $2,315, $1,477 and $1,099 in Ñscal 2004,

2003 and 2002, respectively.

F-12