GameStop 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

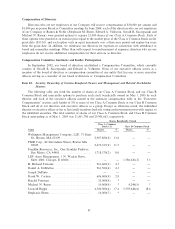

Shares BeneÑcially Owned

Class A Common

Stock (1) Class B Common Stock

Name Shares % Shares %

Gerald R. Szczepanski ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,000(8) * Ì Ì

Edward A. Volkwein ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 16,000(9) * Ì Ì

All directors and executive oÇcers as a group

(10 persons) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,116,100(10) 24.9 5,563,896 18.6

* Less than 1.0%

(1) Shares of Class A Common Stock that an individual or group has a right to acquire within 60 days after

May 1, 2005 pursuant to the exercise of options, warrants or other rights are deemed to be outstanding

for the purpose of computing the beneÑcial ownership of shares and percentage of such individual or

group, but are not deemed to be outstanding for the purpose of computing the beneÑcial ownership of

shares and percentage of any other person or group shown in the table.

(2) Information compiled from Schedule 13G Ñlings.

(3) Of these shares, 961,500 are issuable upon exercise of stock options.

(4) All of these shares are issuable upon exercise of stock options.

(5) These shares are owned by Mr. Rosen's wife.

(6) Of these shares, Mr. Riggio is the direct beneÑcial owner of 3,475,077 shares of Class B Common Stock.

Mr. Riggio is the indirect beneÑcial owner of 1,126,913 shares of Class B Common Stock owned by

Barnes & Noble College Booksellers, Inc., a New York corporation, of which Mr. Riggio owns all of the

currently outstanding voting securities. As co-trustee of The Riggio Foundation, a charitable trust,

Mr. Riggio is the indirect beneÑcial owner of 654,946 shares of Class B Common Stock owned by The

Riggio Foundation. Excluded from these shares are 302,712 shares of Class B Common Stock held in a

rabbi trust established by Barnes & Noble for the beneÑt of Mr. Riggio pursuant to a deferred

compensation arrangement, but over which Mr. Riggio has no voting power.

(7) Of these shares, 15,000 are issuable upon exercise of stock options.

(8) Of these shares, 10,000 are issuable upon exercise of stock options.

(9) Of these shares, 15,000 are issuable upon exercise of stock options. Of the remaining 1,000 shares,

500 shares are owned by Mr. Volkwein's wife, and 250 shares each are owned by Mr. Volkwein's two

children.

(10) Of these shares, 7,104,000 are issuable upon exercise of stock options.

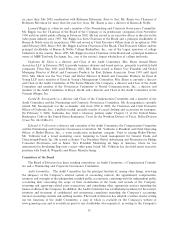

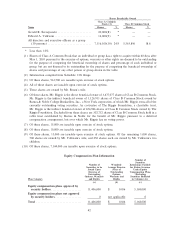

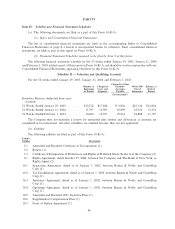

Equity Compensation Plan Information

Number of

Securities

Number of Weighted- Remaining Available

Securities to be Average Exercise for Future Issuance

Issued Upon Price of Under Equity

Exercise of Outstanding Compensation Plans

Outstanding Options, (Excluding

Options, Warrants Warrants and Securities ReÖected

Plan Category and Rights Rights in Column (A))

(a) (b) (c)

Equity compensation plans approved by

security holdersÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,406,000 $ 10.86 5,168,000

Equity compensation plans not approved

by security holders ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0 not applicable 0

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,406,000 $ 10.86 5,168,000

42