GameStop 2004 Annual Report Download - page 29

Download and view the complete annual report

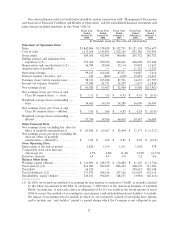

Please find page 29 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rent) the lease allows while the store is being constructed. We also corrected our calculation of

depreciation expense for leasehold improvements for those leases which do not include an option period.

The impact of these corrections on periods prior to Ñscal 2004 was not material and the adjustment does

not aÅect historical or future cash Öows or the timing of payments under related leases. See Note 1 of

""Notes to Consolidated Financial Statements'' of the Company for additional information concerning

lease accounting.

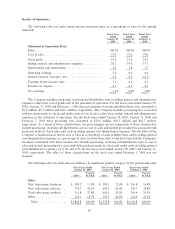

(2) In 2004, the Company changed its classiÑcation of tenant improvement allowances on the balance sheets,

statement of operations and statements of cash Öows. The Company historically classiÑed tenant

improvement allowances as reductions of property and equipment on the Company's balance sheets and

as reductions in depreciation and amortization in the Company's statements of operations. In order to

comply with the provisions of FASB Technical Bulletin No. 88-1, ""Issues Relating to Accounting for

Leases'' (""FTB 88-1''), however, the Company has reclassiÑed tenant improvement allowances as

deferred rent liabilities (in other long-term liabilities) on the Company's balance sheets and as a

reduction of rent expense (in selling, general and administrative expenses) in the statements of

operations. The eÅect of this reclassiÑcation increased total assets and total liabilities on the Company's

balance sheets by $4,671 as of January 29, 2005, $3,265 as of January 31, 2004, $2,328 as of February 1,

2003, $1,831 as of February 2, 2002 and $1,747 as of February 3, 2001 and decreased selling, general and

administrative expense and increased depreciation expense in the Company's statements of operations by

$671, $540, $601, $678 and $649 in Ñscal 2004, 2003, 2002, 2001 and 2000, respectively. Note 1 of

""Notes to Consolidated Financial Statements'' of the Company provides additional information concern-

ing lease accounting.

(3) Net earnings (loss) excluding the after-tax eÅect of goodwill amortization is presented here to provide

additional information about our operations. These items should be considered in addition to, but not as a

substitute for or superior to, operating earnings, net earnings, cash Öow and other measures of Ñnancial

performance prepared in accordance with GAAP.

(4) Stores are included in our comparable store sales base beginning in the 13th month of operation.

Comparable store sales for the Ñscal year ended February 3, 2001 were computed using the Ñrst 52 weeks

of the 53 week Ñscal year.

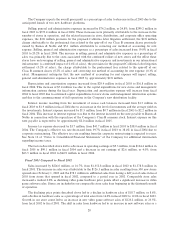

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the information contained in our consoli-

dated Ñnancial statements, including the notes thereto. Statements regarding future economic performance,

management's plans and objectives, and any statements concerning assumptions related to the foregoing

contained in Management's Discussion and Analysis of Financial Condition and Results of Operations

constitute forward-looking statements. Certain factors, which may cause actual results to vary materially from

these forward-looking statements, accompany such statements or appear elsewhere in this Form 10-K/A,

including the factors disclosed under ""Business Ì Risk Factors.''

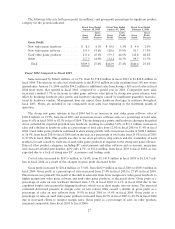

General

We are the largest specialty retailer of video game products and PC entertainment software in the United

States, based on the number of U.S. retail stores we operate and our total U.S. revenues. We sell new and used

video game hardware, video game software and accessories, as well as PC entertainment software and related

accessories and other merchandise. As of January 29, 2005, we operated 1,826 stores, in 50 states, the District

of Columbia, Ireland, Northern Ireland, Puerto Rico and Guam, primarily under the name GameStop. We

also operate an electronic commerce web site under the name gamestop.com and publish Game Informer, the

industry's largest circulation multi-platform video game magazine in the United States.

Our Ñscal year is composed of 52 or 53 weeks ending on the Saturday closest to January 31. The Ñscal

years ended January 29, 2005, or ""Ñscal 2004,'' January 31, 2004, or ""Ñscal 2003,'' and February 1, 2003, or

""Ñscal 2002,'' consisted of 52 weeks.

22