GameStop 2004 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 proved to be another year of milestones

for GameStop. As we have been stating since

going public in February 2002, we believe it is

imperative that we not only perform fi nancially

every year, but that we build the company to take

advantage of the signifi cant growth opportunities

that a growing industry presents.

And with the launch in March 2005 of Sony’s

PlayStation Portable (PSP), scheduled to be

followed in November 2005 by Microsoft’s

Xbox 360, we are at the beginning stages

of another strong cycle of new hardware

products and software launches that will take

advantage of the ever-improving technology.

Furthermore, with GameStop’s merger with

Electronics Boutique moving forward on

schedule, we have positioned our company to

take maximum advantage of these emerging

growth trends.

Some of the 2004 highlights:

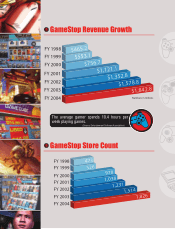

• Our revenues grew 16.7%, from

$1,579,000,000 to $1,843,000,000

• Earnings per share grew over 10%,

from $1.06 per diluted share to $1.17

per diluted share*

• Our stock price increased over 13%,

from $16.60 to $18.80

• We repurchased over 7 million

shares of our common stock

• We invested over $98 million in

new stores and infrastructure

• Our store count grew from 1,514

to 1,826

In addition, GameStop opened 338 stores

worldwide during 2004 - our most aggressive

expansion year ever. In December, we opened

our fi rst store in Wyoming, giving GameStop

a presence in all 50 states.

During the peak holiday season, GameStop

employed 23,000 people. Throughout the

year, we added 700 new full time positions

and 4,000 new part time associates across

the country.

In the course of this year we set sales records

with two titles, selling over 860,000 copies of

Halo 2 and over 780,000 copies of Grand Theft

Auto: San Andreas. Both titles have continued to sell

and are the all-time best sellers for GameStop.

In preparation for continued growth, and with

an eye on improving distribution effi ciency,

we purchased a new 420,000 square foot

general offi ce and distribution center in close

proximity to our old facility, with no resulting

disruption to the support of our stores and no

relocation issues for our people. We managed

to grow our company from approximately 500

stores in 1997 to over 1,900 stores today

without expanding our facilities; the new

distribution center is intended to ensure that

our rapid growth is not compromised, and that

our effi ciency goals will continue to be met.

Game Informer, GameStop’s magazine

division, grew to over 2,000,000 subscribers -

four times larger than our closest competitor.

According to Advertising Age, Game Informer

is now the 26th largest consumer publication

in the US and had the 3rd largest growth in

paid circulation in 2004.

As has been the case every year since we have

been a public company, GameStop’s market

share has grown; 2004 was no exception.

According to NPD Group data, our total share

of the growing video game market was 11.4%,

up from 9.8% in 2003. What is particularly

encouraging about our share growth is that

we have continuously found better ways to

serve new markets.

Dear Shareholders,

Letter to the Shareholders

* Before special charges of $0.12 per diluted share for California litigation settlement costs, professional fees relating to the spin-off by

Barnes & Noble, Inc. of our Class B common stock and the change in our method of accounting for leases.