GameStop 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Carlson, our Executive Vice President and Chief Financial OÇcer. The loss of services of any of our key

personnel could have a negative impact on our business.

We may engage in acquisitions which could negatively impact our business if we fail to successfully

complete and integrate them.

To enhance our eÅorts to grow and compete, we may engage in acquisitions. Our plans to pursue future

acquisitions are subject to our ability to negotiate favorable terms for these acquisitions. Accordingly, we

cannot assure you that future acquisitions will be completed. In addition, to facilitate future acquisitions, we

may take actions that could dilute the equity interests of our stockholders, increase our debt or cause us to

assume contingent liabilities, all of which may have a detrimental eÅect on the price of our common stock.

Finally, if any acquisitions are not successfully integrated with our business, our ongoing operations could be

adversely aÅected.

Legislative actions, higher director and oÇcer insurance costs and potential new accounting

pronouncements are likely to cause our general and administrative expenses to increase and impact our

future Ñnancial condition and results of operations.

In order to comply with the Sarbanes-Oxley Act of 2002, as well as changes to the New York Stock

Exchange listing standards and rules adopted by the Securities and Exchange Commission (the ""SEC''), we

may be required to increase our expenditures on internal controls, and hire additional personnel and additional

outside legal, accounting and advisory services, all of which may cause our general and administrative costs to

increase. Insurers are also likely to increase premiums as a result of the high claims rates they have incurred in

the past from other companies, and so our premiums for our directors' and oÇcers' insurance policies are

likely to increase. Changes in the accounting rules could materially increase the expenses that we report under

generally accepted accounting principles (""GAAP'') and adversely aÅect our operating results.

The limited voting rights of our Class A common stock could impact its attractiveness to investors and

its liquidity and, as a result, its market value.

The holders of our Class A and Class B common stock generally have identical rights, except that holders

of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are

entitled to ten votes per share on all matters to be voted on by stockholders. The diÅerence in the voting rights

of the Class A and Class B common stock could diminish the value of the Class A common stock to the extent

that investors or any potential future purchasers of our Class A common stock ascribe value to the superior

voting rights of the Class B common stock.

Industry Background

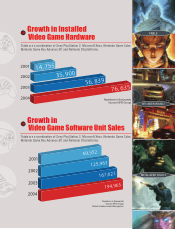

According to NPD Group, Inc., a market research Ñrm, the electronic game industry was an

approximately $11.0 billion market in the United States in 2004. Of this $11.0 billion market, approximately

$10.0 billion was attributable to video game products, excluding sales of used video game products, and

approximately $1.0 billion was attributable to PC entertainment software.

New Video Game Products. The Entertainment Software Association (formerly the Interactive Digital

Software Association), or ESA, estimates that 50% of all Americans, or approximately 145 million people,

play video or computer games on a regular basis. We expect the following trends to result in increased sales of

video game products:

‚Hardware Platform Technology Evolution. Video game hardware has evolved signiÑcantly from the

early products launched in the 1980s. The processing speed of video game hardware has increased from

8-bit speeds in the 1980s to 128-bit speeds in next-generation systems such as Sony PlayStation 2,

launched in 2000, and Nintendo GameCube and Microsoft Xbox, which both launched in November

2001. In addition, portable handheld video game devices have evolved from the 8-bit Nintendo Game

Boy to the 128-bit Nintendo DS, which was introduced in November 2004. Technological develop-

ments in both chip processing speed and data storage have provided signiÑcant improvements in

7