GameStop 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our wholly-owned subsidiary Babbage's began operations in November 1996. In October 1999,

Babbage's was acquired by, and became a wholly-owned subsidiary of, Barnes & Noble. In June 2000,

Barnes & Noble acquired Funco and thereafter, Babbage's became a wholly-owned subsidiary of Funco. In

December 2000, Funco changed its name to GameStop, Inc.

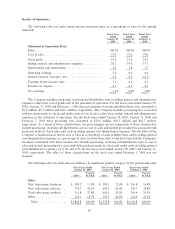

Growth in the video game industry is driven by the introduction of new technology. In October 2000,

Sony introduced PlayStation 2 and, in November 2001, Microsoft introduced Xbox and Nintendo introduced

GameCube. Nintendo introduced the Game Boy Advance SP in March 2003 and the DS in November 2004.

As is typical following the introduction of new video game platforms, sales of new video game hardware

generally increase as a percentage of sales in the Ñrst full year following introduction. As video game platforms

mature, the sales mix attributable to complementary video game software and accessories, which generate

higher gross margins, generally increases in the second and third years. The net eÅect is generally a decline in

gross margins in the Ñrst full year following new platform releases and an increase in gross margins in the

second and third years. Unit sales of maturing video game platforms are typically also driven by manufacturer-

funded retail price decreases, further driving sales of related software and accessories. The retail prices for the

PlayStation 2, the Xbox and the GameCube were reduced in May 2002 and May 2003, resulting in an

increase in unit sales and sales of the related software and accessories. In September 2003, Nintendo reduced

the retail price of the GameCube, which resulted in a signiÑcant increase in unit sales and sales of the related

software and accessories during the fourth quarter of 2003. In March 2004, Microsoft reduced the retail price

of the Xbox and, in May 2004, Sony reduced the retail price of the PlayStation2. We expect that the installed

base of these hardware platforms and sales of related software and accessories will increase in the future. Sony

launched the PSP in March 2005 and the Company anticipates that Microsoft will launch the Xbox 2 in

November 2005. Because of these anticipated launches, we expect that our gross margin will decline from

Ñscal 2004 to Ñscal 2005.

Critical Accounting Policies

The Company believes that the following are its most signiÑcant accounting policies which are important

in determining the reporting of transactions and events.

Use of Estimates. The preparation of Ñnancial statements in conformity with GAAP requires manage-

ment to make estimates and assumptions that aÅect the reported amounts of assets and liabilities, the

disclosure of contingent assets and liabilities at the date of the Ñnancial statements and the reported amounts

of revenues and expenses during the reporting period. In preparing these Ñnancial statements, management

has made its best estimates and judgments of certain amounts included in the Ñnancial statements, giving due

consideration to materiality. Changes in the estimates and assumptions used by management could have

signiÑcant impact on the Company's Ñnancial results. Actual results could diÅer from those estimates.

Revenue Recognition. Revenue from the sales of the Company's products is recognized at the time of

sale. The sales of used video game products are recorded at the retail price charged to the customer. Sales

returns (which are not signiÑcant) are recognized at the time returns are made. Subscription and advertising

revenues are recorded upon release of magazines for sale to consumers and are stated net of sales discounts.

Magazine subscription revenue is recognized on a straight-line basis over the subscription period.

Merchandise Inventories. Our merchandise inventories are carried at the lower of cost or market using

the average cost method. Used video game products traded in by customers are recorded as inventory at the

amount of the store credit given to the customer. In valuing inventory, management is required to make

assumptions regarding the necessity of reserves required to value potentially obsolete or over-valued items at

the lower of cost or market. Management considers quantities on hand, recent sales, potential price protections

and returns to vendors, among other factors, when making these assumptions.

Property and Equipment. Property and equipment are carried at cost less accumulated depreciation and

amortization. Depreciation on furniture, Ñxtures and equipment is computed using the straight-line method

over estimated useful lives (ranging from two to eight years). Maintenance and repairs are expensed as

incurred, while betterments and major remodeling costs are capitalized. Leasehold improvements are

capitalized and amortized over the shorter of their estimated useful lives or the terms of the respective leases,

23