GameStop 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

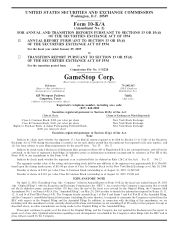

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 2)

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

¥ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Ñscal year ended January 29, 2005

or

nTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 1-31228

GameStop Corp.

(Exact name of registrant as speciÑed in its Charter)

Delaware 75-2951347

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) IdentiÑcation No.)

625 Westport Parkway 76051

Grapevine, Texas (Zip Code)

(Address of principal executive oÇces)

Registrant's telephone number, including area code:

(817) 424-2000

Securities registered pursuant to Section 12(b) of the Act:

(Title of Class) (Name of Exchange on Which Registered)

Class A Common Stock, $.001 par value per share New York Stock Exchange

Class B Common Stock, $.001 par value per share New York Stock Exchange

Rights to Purchase Series A Junior Participating Preferred Stock, New York Stock Exchange

$.001 par value per share

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant: (1) has Ñled all reports required to be Ñled by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to Ñle such reports), and

(2) has been subject to such Ñling requirements for the past 90 days. Yes ¥No n

Indicate by check mark if disclosure of delinquent Ñlers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant's knowledge, in deÑnitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. ¥

Indicate by check mark whether the registrant is an accelerated Ñler (as deÑned on Rule 12b-2 of the Act). Yes ¥No n

The aggregate market value of the voting and non-voting stock held by non-aÇliates of the registrant was approximately $311,396,000,

based upon the closing market price of $15.40 per share of Class A Common Stock on the New York Stock Exchange as of July 30, 2004.

Number of shares of $.001 par value Class A Common Stock outstanding as of August 30, 2005: 21,949,509

Number of shares of $.001 par value Class B Common Stock outstanding as of August 30, 2005: 29,901,662

EXPLANATORY NOTE

On April 11, 2005, GameStop Corp. (the ""Company'') Ñled its Annual Report on Form 10-K for the Ñscal year ended January 29, 2005

(the ""Original Filing'') with the Securities and Exchange Commission (the ""SEC''). As a result of the Company's expectation that it would

not Ñle its deÑnitive proxy statement within 120 days after the end of the Ñscal year covered by the Original Filing, the Company Ñled

Amendment No. 1 on Form 10-K/A (the ""Amended Filing'') on May 20, 2005 in order to furnish the information required by Items 10, 11,

12, 13 and 14 of Part III of Form 10-K. The Company hereby amends Item 1 of Part I and Items 7 and 8 of Part II of the Amended Filing,

and the Company's consolidated Ñnancial statements (including the notes thereto), to respond to comments the Company received from the

SEC with respect to the Original Filing and the Amended Filing. In addition, in connection with the Ñling of this amendment, we are

including with this amendment certain currently dated certiÑcations and therefore we are amending Part IV solely for that purpose. Except as

described above, no other amendments are being made to the Original Filing or the Amended Filing.

This report continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures in this report to

speak as of a later date. Updated information regarding recent developments is included in the Company's other Ñlings with the SEC and in

press releases issued by the Company.