GameStop 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

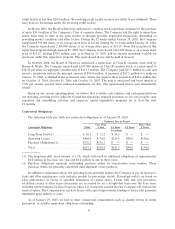

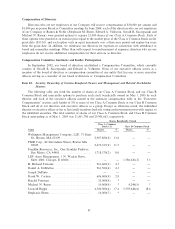

Compensation of Directors

Directors who are not employees of our Company will receive compensation of $30,000 per annum and

$1,000 per in-person Board or Committee meeting. In June 2004, each of the directors who are not employees

of our Company or Barnes & Noble (Stephanie M. Shern, Edward A. Volkwein, Gerald R. Szczepanski and

Michael N. Rosen) were granted options to acquire 21,000 shares of our Class A Common Stock. Each of

these options were granted at an exercise price equal to the market price of the Class A Common Stock on the

grant date ($15.10) and each option vests in equal increments over a three-year period and expires ten years

from the grant date. In addition, we reimburse our directors for expenses in connection with attendance at

board and committee meetings. Other than with respect to reimbursement of expenses, directors who are our

employees do not receive additional compensation for their services as directors

Compensation Committee Interlocks and Insider Participation

In September 2002, our board of directors established a Compensation Committee, which currently

consists of Gerald R. Szczepanski and Edward A. Volkwein. None of our executive oÇcers serves as a

member of the board of directors or compensation committee of any entity that has one or more executive

oÇcers serving as a member of our board of directors or Compensation Committee.

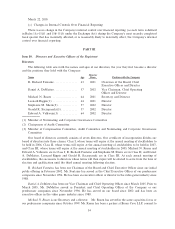

Item 12. Security Ownership of Certain BeneÑcial Owners and Management and Related Stockholder

Matters

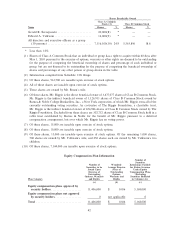

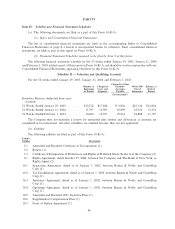

The following table sets forth the number of shares of our Class A Common Stock and our Class B

Common Stock and exercisable options to purchase such stock beneÑcially owned on May 1, 2005 by each

director and each of the executive oÇcers named in the summary compensation table in the ""Executive

Compensation'' section, each holder of 5% or more of our Class A Common Stock or our Class B Common

Stock and all of our directors and executive oÇcers as a group. Except as otherwise noted, the individual

director or executive oÇcer or his or her family members had sole voting and investment power with respect to

the identiÑed securities. The total number of shares of our Class A Common Stock and Class B Common

Stock outstanding as of May 1, 2005 was 21,431,798 and 29,901,662, respectively.

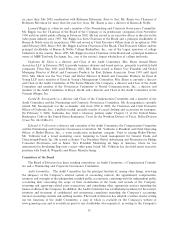

Shares BeneÑcially Owned

Class A Common

Stock (1) Class B Common Stock

Name Shares % Shares %

Wellington Management Company, LLP, 75 State

St., Boston, MA 02109 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,907,800(2) 13.6 Ì Ì

FMR Corp., 82 Devonshire Street, Boston MA

02109ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,475,107(2) 11.5 Ì Ì

Franklin Resources, Inc., One Franklin Parkway,

San Mateo, CA 94403ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,718,370(2) 8.0 Ì Ì

LSV Asset Management, 1 N. Wacker Drive,

Suite 4000, Chicago, Il 60606 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 1,586,626(2) 5.3

R. Richard Fontaine ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 961,600(3) 4.3 Ì Ì

Daniel A. DeMatteo ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 961,500(4) 4.3 Ì Ì

Joseph DePinto ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì

David W. Carlson ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 606,000(4) 2.8 Ì Ì

Ronald FreemanÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 25,000(4) * Ì Ì

Michael N. Rosen ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,000(4) * 4,248(5) *

Leonard RiggioÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,500,000(4) 17.4 5,559,648(6) 18.6

Stephanie ShernÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 16,000(7) * Ì Ì

41