GameStop 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

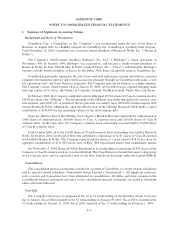

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of SigniÑcant Accounting Policies

Background and Basis of Presentation

GameStop Corp. (""GameStop'' or the ""Company'') was incorporated under the laws of the State of

Delaware in August 2001 as a holding company for GameStop, Inc. GameStop is a publicly held company.

Until November 12, 2004, GameStop was a majority-owned subsidiary of Barnes & Noble, Inc. (""Barnes &

Noble'').

The Company's wholly-owned subsidiary Babbage's Etc. LLC (""Babbage's'') began operations in

November 1996. In October 1999, Babbage's was acquired by, and became a wholly-owned subsidiary of,

Barnes & Noble. In June 2000, Barnes & Noble acquired Funco, Inc. (""Funco'') and thereafter, Babbage's

became a wholly-owned subsidiary of Funco. In December 2000, Funco changed its name to GameStop, Inc.

GameStop is principally engaged in the sale of new and used video game systems and software, personal

computer entertainment software and related accessories primarily through its GameStop trade name, a web

site (gamestop.com) and Game Informer magazine. The Company operates its business as a single segment.

The Company's stores, which totaled 1,826 at January 29, 2005, are located in major regional shopping malls

and strip centers in 50 states, the District of Columbia, Ireland, Northern Ireland, Puerto Rico and Guam.

In February 2002, the Company completed a public oÅering of 20,764 shares of Class A common stock at

$18.00 per share (the ""OÅering''). The net proceeds of the OÅering, after deducting applicable issuance costs

and expenses, were $347,339. A portion of the net proceeds was used to repay $250,000 of intercompany debt

owed to Barnes & Noble. Additionally, upon the eÅective date of the OÅering, Barnes & Noble made a capital

contribution of $150,000 for the remaining balance of the intercompany debt.

Upon the eÅective date of the OÅering, the Company's Board of Directors approved the authorization of

5,000 shares of preferred stock, 300,000 shares of Class A common stock and 100,000 shares of Class B

common stock. At the same time, the Company's common stock outstanding was converted to 36,009 shares

of Class B common stock.

Until October 2004, all of the 36,009 shares of Class B common stock outstanding were held by Barnes &

Noble. In October 2004, the Board of Directors authorized a repurchase of 6,107 shares of Class B common

stock held by Barnes & Noble. The Company repurchased the shares at a price equal to $18.26 per share for

aggregate consideration of $111,520 before costs of $261. The repurchased shares were immediately retired.

On November 12, 2004, Barnes & Noble distributed to its stockholders its remaining 29,902 shares of the

Company's Class B common stock in a tax-free dividend. The Class B shares retained their super voting power

of ten votes per share and are separately listed on the New York Stock Exchange under the symbol GME.B.

Consolidation

The consolidated Ñnancial statements include the accounts of GameStop, its wholly-owned subsidiaries

and its majority-owned subsidiary, Gamesworld Group Limited (""Gamesworld''). All signiÑcant intercom-

pany accounts and transactions have been eliminated in consolidation. All dollar and share amounts in the

consolidated Ñnancial statements and notes to the consolidated Ñnancial statements are stated in thousands

unless otherwise indicated.

Year-End

The Company's Ñscal year is composed of the 52 or 53 weeks ending on the Saturday closest to the last

day of January. Fiscal 2004 consisted of the 52 weeks ending on January 29, 2005. Fiscal 2003 consisted of the

52 weeks ending on January 31, 2004. Fiscal 2002 consisted of the 52 weeks ending on February 1, 2003.

F-9