Frontier Communications 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

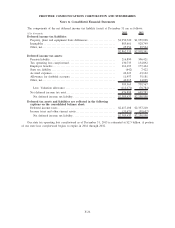

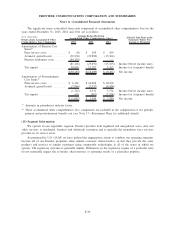

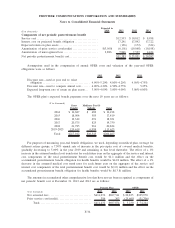

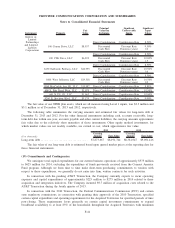

($ in thousands)

Expected in

2014 2013 2012 2011

Components of net periodic postretirement benefit

Service cost ................................................ $12,533 $ 10,812 $ 8,958

Interest cost on projected benefit obligation .................. 17,241 17,842 17,722

Expected return on plan assets............................... (136) (172) (324)

Amortization of prior service cost/(credit) .................... $(3,560) (6,101) (10,068) (10,198)

Amortization of unrecognized loss ........................... 2,886 7,846 7,537 4,424

Net periodic postretirement benefit cost ...................... $31,383 $ 25,951 $ 20,582

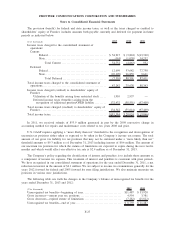

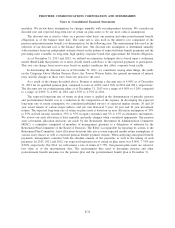

Assumptions used in the computation of annual OPEB costs and valuation of the year-end OPEB

obligations were as follows:

2013 2012 2011

Discount rate—used at year end to value

obligation . . . .................................. 4.90%-5.20% 4.00%-4.20% 4.50%-4.75%

Discount rate—used to compute annual cost ....... 4.00%-4.20% 4.50%-4.75% 5.25%

Expected long-term rate of return on plan assets. . . 3.00%-4.00% 3.00%-4.00% 3.00%-6.00%

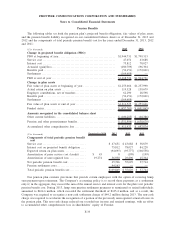

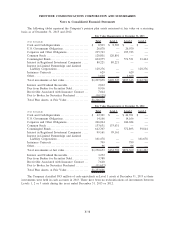

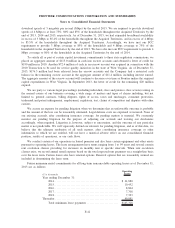

The OPEB plan’s expected benefit payments over the next 10 years are as follows:

($ in thousands)

Gross

Benefit

Medicare Part D

Subsidy Total

2014 $ 16,687 $ 489 $ 16,198

2015 18,004 585 17,419

2016 19,342 691 18,651

2017 20,575 825 19,750

2018 21,785 961 20,824

2019-2023 120,619 6,994 113,625

Total $217,012 $10,545 $206,467

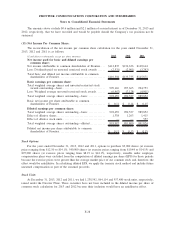

For purposes of measuring year-end benefit obligations, we used, depending on medical plan coverage for

different retiree groups, a 7.50% annual rate of increase in the per-capita cost of covered medical benefits,

gradually decreasing to 5.00% in the year 2019 and remaining at that level thereafter. The effect of a 1%

increase in the assumed medical cost trend rates for each future year on the aggregate of the service and interest

cost components of the total postretirement benefit cost would be $1.1 million and the effect on the

accumulated postretirement benefit obligation for health benefits would be $14.8 million. The effect of a 1%

decrease in the assumed medical cost trend rates for each future year on the aggregate of the service and

interest cost components of the total postretirement benefit cost would be $(1.0) million and the effect on the

accumulated postretirement benefit obligation for health benefits would be $(13.8) million.

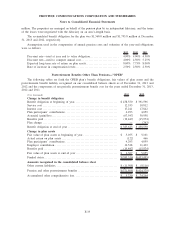

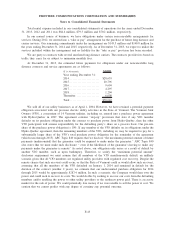

The amounts in accumulated other comprehensive loss that have not yet been recognized as components of

net periodic benefit cost at December 31, 2013 and 2012 are as follows:

($ in thousands) 2013 2012 2013 2012

Pension Plan OPEB

Net actuarial loss ................................. $411,076 $697,511 $ 30,835 $105,970

Prior service cost/(credit) . . ........................ 356 363 (25,605) (31,706)

Total......................................... $411,432 $697,874 $ 5,230 $ 74,264

F-36

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements