Frontier Communications 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

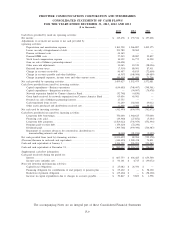

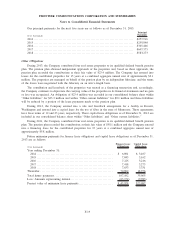

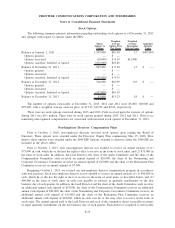

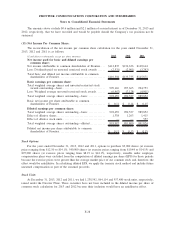

Our principal payments for the next five years are as follows as of December 31, 2013:

($ in thousands)

Principal

Payments

2014 ............................................................................... $257,916

2015 ............................................................................... $259,840

2016 ............................................................................... $345,466

2017 ............................................................................... $607,375

2018 ............................................................................... $583,273

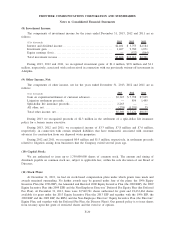

Other Obligations

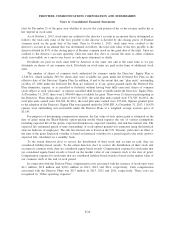

During 2013, the Company contributed four real estate properties to its qualified defined benefit pension

plan. The pension plan obtained independent appraisals of the properties and, based on these appraisals, the

pension plan recorded the contributions at their fair value of $23.4 million. The Company has entered into

leases for the contributed properties for 15 years at a combined aggregate annual rent of approximately $2.1

million. The properties are managed on behalf of the pension plan by an independent fiduciary, and the terms

of the leases were negotiated with the fiduciary on an arm’s-length basis.

The contribution and leaseback of the properties was treated as a financing transaction and, accordingly,

the Company continues to depreciate the carrying value of the properties in its financial statements and no gain

or loss was recognized. An obligation of $23.4 million was recorded in our consolidated balance sheet within

“Other liabilities” for $23.3 million and within “Other current liabilities” for $0.1 million and these liabilities

will be reduced by a portion of the lease payments made to the pension plan.

During 2012, the Company entered into a sale and leaseback arrangement for a facility in Everett,

Washington and entered into a capital lease for the use of fiber in the state of Minnesota. These agreements

have lease terms of 12 and 23 years, respectively. These capital lease obligations as of December 31, 2012 are

included in our consolidated balance sheet within “Other liabilities” and “Other current liabilities.”

During 2011, the Company contributed four real estate properties to its qualified defined benefit pension

plan. The pension plan recorded the contributions at their fair value of $58.1 million and the Company entered

into a financing lease for the contributed properties for 15 years at a combined aggregate annual rent of

approximately $5.8 million.

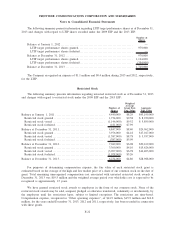

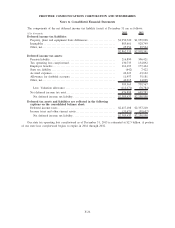

Future minimum payments for finance lease obligations and capital lease obligations as of December 31,

2013 are as follows:

($ in thousands)

Finance Lease

Obligations

Capital Lease

Obligations

Year ending December 31:

2014 ............................................................ $ 6,891 $ 3,107

2015 ............................................................ 7,043 3,162

2016 ............................................................ 7,225 3,216

2017 ............................................................ 7,418 3,273

2018 ............................................................ 7,633 3,331

Thereafter . . . ...................................................... 70,892 18,976

Total future payments . ............................................. 107,102 35,065

Less: Amounts representing interest ................................. (63,174) (9,983)

Present value of minimum lease payments........................... $ 43,928 $25,082

F-19

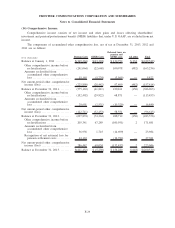

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements