Frontier Communications 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

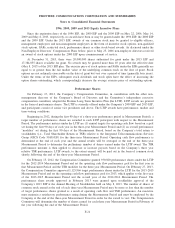

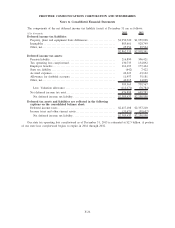

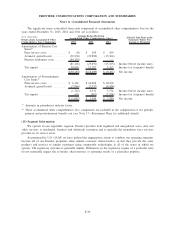

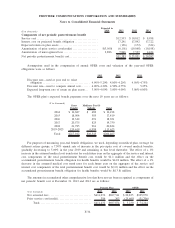

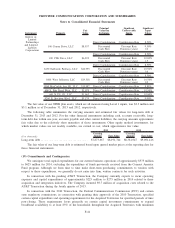

(16) Quarterly Financial Data (Unaudited):

($ in thousands, except per share amounts)

First Quarter Second Quarter Third Quarter Fourth Quarter Total Year

2013

Revenue . . . . . . . . . . . . . . . . . . . . . . $1,205,396 $1,190,533 $1,185,278 $1,180,369 $4,761,576

Operating income . . . . . . . . . . . . . 250,824 266,156 206,172 257,569 980,721

Net income (loss) attributable

to common shareholders of

Frontier . . . . . . . . . . . . . . . . . . . . 48,140 (38,460) 35,400 67,755 112,835

Basic net income (loss) per

common share attributable to

common shareholders of

Frontier . . . . . . . . . . . . . . . . . . . . $ 0.05 $ (0.04) $ 0.04 $ 0.07 $ 0.11

2012

Revenue . . . . . . . . . . . . . . . . . . . . . . $1,268,054 $1,258,777 $1,252,469 $1,232,553 $5,011,853

Operating income . . . . . . . . . . . . . 208,458 267,784 275,196 235,730 987,168

Net income attributable to

common shareholders of

Frontier . . . . . . . . . . . . . . . . . . . . 26,768 17,989 67,000 24,879 136,636

Basic net income per common

share attributable to common

shareholders of Frontier . . . . . $ 0.03 $ 0.02 $ 0.07 $ 0.02 $ 0.14

The quarterly net income per common share amounts are rounded to the nearest cent. Annual net income

per common share may vary depending on the effect of such rounding.

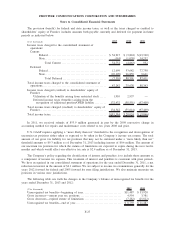

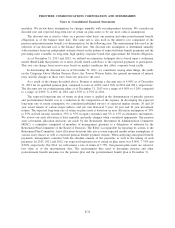

We recognized $9.7 million ($6.1 million or $0.01 per share after tax) of acquisition costs during the

fourth quarter of 2013.

We recognized $40.3 million ($25.0 million or $0.03 per share after tax) and $3.9 million ($2.4 million

after tax) of pension settlement costs in the third and fourth quarters of 2013, respectively.

We recognized $159.8 million ($98.9 million or $0.10 per share after tax) of losses on early

extinguishment of debt during the second quarter of 2013.

We recognized $35.1 million ($21.7 million or $0.02 per share after tax), $28.6 million ($18.1 million or

$0.02 per share after tax), $4.5 million ($2.9 million after tax), and $13.5 million ($9.1 million or $0.01 per

share after tax) of integration costs during the first, second, third and fourth quarters of 2012, respectively.

We recognized $70.8 million ($44.5 million or $0.04 per share after tax), $0.2 million ($0.2 million after

tax) and $19.3 million ($12.1 million or $0.01 per share after tax) of losses on early extinguishment of debt

during the second, third and fourth quarters of 2012, respectively.

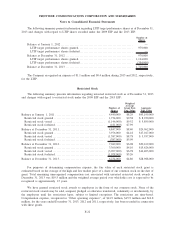

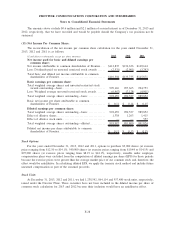

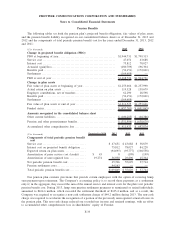

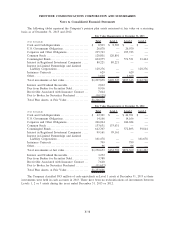

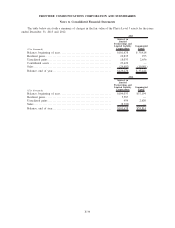

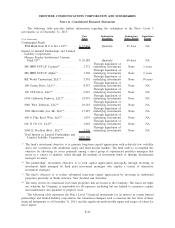

(17) Retirement Plans:

We sponsor a noncontributory defined benefit pension plan covering a significant number of our former

and current employees and other postretirement benefit plans that provide medical, dental, life insurance and

other benefits for covered retired employees and their beneficiaries and covered dependents. The benefits are

based on years of service and final average pay or career average pay. Contributions are made in amounts

sufficient to meet ERISA funding requirements while considering tax deductibility. Plan assets are invested in a

diversified portfolio of equity and fixed-income securities and alternative investments.

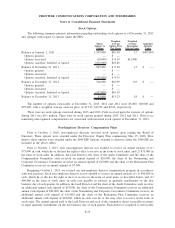

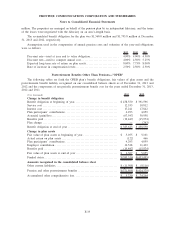

The accounting results for pension and other postretirement benefit costs and obligations are dependent

upon various actuarial assumptions applied in the determination of such amounts. These actuarial assumptions

include the following: discount rates, expected long-term rate of return on plan assets, future compensation

increases, employee turnover, healthcare cost trend rates, expected retirement age, optional form of benefit and

F-31

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements