Frontier Communications 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1996, 2000, 2009 and 2013 Equity Incentive Plans

Since the expiration dates of the 1996 EIP, the 2000 EIP and the 2009 EIP on May 22, 2006, May 14,

2009 and May 8, 2013, respectively, no awards have been or may be granted under the 1996 EIP, the 2000 EIP

and the 2009 EIP. Under the 2013 EIP, awards of our common stock may be granted to eligible officers,

management employees and non-management employees in the form of incentive stock options, non-qualified

stock options, SARs, restricted stock, performance shares or other stock-based awards. As discussed under the

Non-Employee Directors’ Compensation Plans below, prior to May 25, 2006 non-employee directors received

an award of stock options under the 2000 EIP upon commencement of service.

At December 31, 2013, there were 20,000,000 shares authorized for grant under the 2013 EIP and

17,384,055 shares available for grant. No awards may be granted more than 10 years after the effective date

(May 8, 2013) of the 2013 EIP plan. The exercise price of stock options and SARs under the EIPs generally are

equal to or greater than the fair market value of the underlying common stock on the date of grant. Stock

options are not ordinarily exercisable on the date of grant but vest over a period of time (generally four years).

Under the terms of the EIPs, subsequent stock dividends and stock splits have the effect of increasing the

option shares outstanding, which correspondingly decrease the average exercise price of outstanding options.

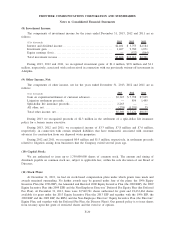

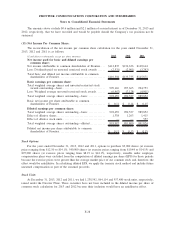

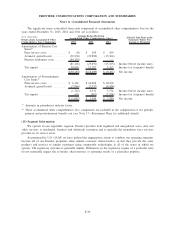

Performance Shares

On February 15, 2012, the Company’s Compensation Committee, in consultation with the other non-

management directors of the Company’s Board of Directors and the Committee’s independent executive

compensation consultant, adopted the Frontier Long-Term Incentive Plan (the LTIP). LTIP awards are granted

in the form of performance shares. The LTIP is currently offered under the Company’s 2009 EIP and 2013 EIP,

and participants consist of senior vice presidents and above. The LTIP awards have performance, market and

time-vesting conditions.

Beginning in 2012, during the first 90 days of a three-year performance period (a Measurement Period), a

target number of performance shares are awarded to each LTIP participant with respect to the Measurement

Period. The performance metrics under the LTIP are (1) annual targets for operating cash flow based on a goal

set during the first 90 days of each year in the three-year Measurement Period and (2) an overall performance

“modifier” set during the first 90 days of the Measurement Period, based on the Company’s total return to

stockholders (i.e., Total Shareholder Return or TSR) relative to the Integrated Telecommunications Services

Group (GICS Code 50101020) for the three-year Measurement Period. Operating cash flow performance is

determined at the end of each year and the annual results will be averaged at the end of the three-year

Measurement Period to determine the preliminary number of shares earned under the LTIP award. The TSR

performance measure is then applied to decrease or increase payouts based on the Company’s three year

relative TSR performance. LTIP awards, to the extent earned, will be paid out in the form of common stock

shortly following the end of the three-year Measurement Period.

On February 15, 2012, the Compensation Committee granted 930,020 performance shares under the LTIP

for the 2012-2014 Measurement Period and set the operating cash flow performance goal for the first year in

that Measurement Period and the TSR modifier for the three-year Measurement Period. On February 27, 2013,

the Compensation Committee approved 1,123,966 target performance shares under the LTIP for the 2013-2015

Measurement Period and set the operating cash flow performance goal for 2013, which applies to the first year

of the 2013-2015 Measurement Period and the second year of the 2012-2014 Measurement Period. The

performance share awards approved in February 2013 were granted upon stockholder approval of the

Company’s 2013 EIP at the Annual Meeting of Stockholders held on May 8, 2013. The number of shares of

common stock earned at the end of each three-year Measurement Period may be more or less than the number

of target performance shares granted as a result of operating cash flow and TSR performance. An executive

must maintain a satisfactory performance rating during the Measurement Period and must be employed by the

Company at the end of the three-year Measurement Period in order for the award to vest. The Compensation

Committee will determine the number of shares earned for each three year Measurement Period in February of

the year following the end of the Measurement Period.

F-21

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements