Frontier Communications 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

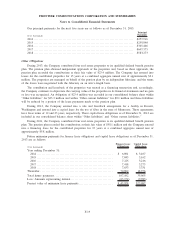

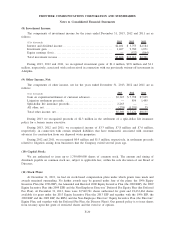

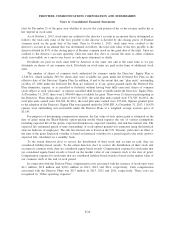

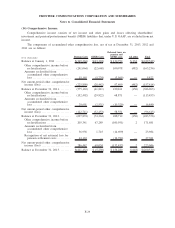

(8) Investment Income:

The components of investment income for the years ended December 31, 2013, 2012 and 2011 are as

follows:

($ in thousands) 2013 2012 2011

Interest and dividend income ....................................... $2,401 $ 3,753 $2,184

Investment gain. ................................................... 1,407 9,780 1,071

Equity earnings (loss) .............................................. — (522) (864)

Total investment income . .......................................... $3,808 $13,011 $2,391

During 2013, 2012 and 2011, we recognized investment gains of $1.4 million, $9.8 million and $1.1

million, respectively, associated with cash received in connection with our previously written-off investment in

Adelphia.

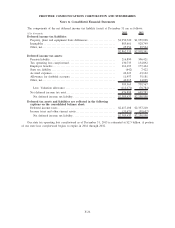

(9) Other Income, Net:

The components of other income, net for the years ended December 31, 2013, 2012 and 2011 are as

follows:

($ in thousands) 2013 2012 2011

Gain on expiration/settlement of customer advances . ................. $3,345 $ 7,798 $7,605

Litigation settlement proceeds....................................... — 854 1,495

Split-dollar life insurance proceeds .................................. 2,263 — —

All other, net . ..................................................... (239) (1,531) 35

Total other income, net. ............................................ $5,369 $ 7,121 $9,135

During 2013 we recognized proceeds of $2.3 million in the settlement of a split-dollar life insurance

policy for a former senior executive.

During 2013, 2012 and 2011, we recognized income of $3.3 million, $7.8 million and $7.6 million,

respectively, in connection with certain retained liabilities that have terminated, associated with customer

advances for construction from our disposed water properties.

During 2012 and 2011, we recognized $0.9 million and $1.5 million, respectively, in settlement proceeds

related to litigation arising from businesses that the Company exited several years ago.

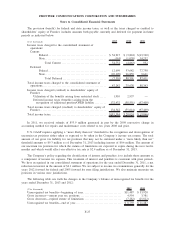

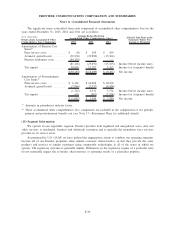

(10) Capital Stock:

We are authorized to issue up to 1,750,000,000 shares of common stock. The amount and timing of

dividends payable on common stock are, subject to applicable law, within the sole discretion of our Board of

Directors.

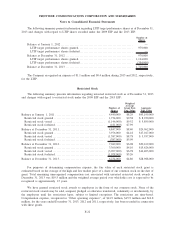

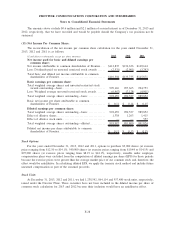

(11) Stock Plans:

At December 31, 2013, we had six stock-based compensation plans under which grants were made and

awards remained outstanding. No further awards may be granted under four of the plans: the 1996 Equity

Incentive Plan (the 1996 EIP), the Amended and Restated 2000 Equity Incentive Plan (the 2000 EIP), the 2009

Equity Incentive Plan (the 2009 EIP) and the Non-Employee Directors’ Deferred Fee Equity Plan (the Deferred

Fee Plan). At December 31, 2013, there were 22,540,761 shares authorized for grant and 18,432,664 shares

available for grant under the 2013 Equity Incentive Plan (the 2013 EIP and together with the 1996 EIP, the

2000 EIP and the 2009 EIP, the EIPs) and the Non-Employee Directors’ Equity Incentive Plan (the Directors’

Equity Plan, and together with the Deferred Fee Plan, the Director Plans). Our general policy is to issue shares

from treasury upon the grant of restricted shares and the exercise of options.

F-20

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements