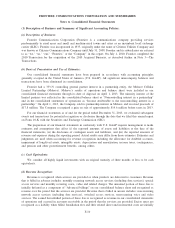

Frontier Communications 2013 Annual Report Download - page 80

Download and view the complete annual report

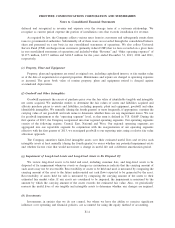

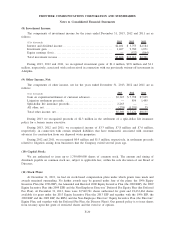

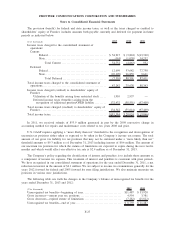

Please find page 80 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On May 17, 2012, the Company completed a registered offering of $500 million aggregate principal

amount of 9.250% senior unsecured notes due 2021, issued at a price of 100% of their principal amount. We

received net proceeds of $489.6 million from the offering after deducting underwriting fees and offering

expenses. The Company also commenced a tender offer to purchase the maximum aggregate principal amount

of its 8.250% Senior Notes due 2014 (the 2014 Notes) and the April 2015 Notes (and together with the 2014

Notes, the Notes) that it could purchase for up to $500 million in cash (the 2012 Debt Tender Offer).

Pursuant to the 2012 Debt Tender Offer, the Company accepted for purchase $400 million aggregate

principal amount of 2014 Notes, tendered for total consideration of $446.0 million, and $49.5 million aggregate

principal amount of April 2015 Notes, tendered for total consideration of $54.0 million. The Company used

proceeds from the sale of its May 2012 offering of $500 million of 9.250% Senior Notes due 2021, plus cash

on hand, to purchase the Notes.

In connection with the 2012 Debt Tender Offer and repurchase of the Notes, the Company recognized a

loss of $69.0 million for the premium paid on the early extinguishment of debt during 2012. We also

recognized losses of $2.1 million during 2012 for $78.1 million in total open market repurchases of our 6.25%

Senior Notes due 2013.

On August 15, 2012, the Company completed a registered offering of $600 million aggregate principal

amount of 7.125% senior unsecured notes due 2023 (the 2023 Notes), issued at a price of 100% of their

principal amount. We received net proceeds of $588.1 million from the offering after deducting underwriting

fees and offering expenses. The Company used the net proceeds from the sale of the notes to repurchase or

retire existing indebtedness in 2013.

On October 1, 2012, the Company completed a registered debt offering of $250 million aggregate

principal amount of the 2023 Notes, issued at a price of 104.250% of their principal amount. We received net

proceeds of $255.9 million from the offering after deducting underwriting fees and offering expenses. The

notes are an additional issuance of, are fully fungible with and form a single series voting together as one class

with the $600 million aggregate principal amount of the 2023 Notes issued by the Company on August 15,

2012. The Company used the net proceeds from the sale of the notes to repurchase or retire existing

indebtedness in 2013.

On October 1, 2012, the Company accepted for purchase $75.7 million and $59.3 million aggregate

principal amount of the April 2015 Notes and the 2017 Notes, respectively, in open market repurchases for total

consideration of $154.7 million. The repurchases resulted in a loss on the early retirement of debt of $19.3

million.

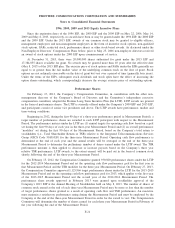

In 2011, we retired an aggregate principal amount of $552.4 million of debt, consisting of $551.4 million

of senior unsecured debt and $1.0 million of rural utilities service loan contracts.

As of December 31, 2013, we were in compliance with all of our debt and credit facility financial

covenants.

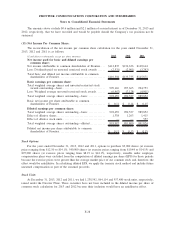

On December 16, 2013, we signed a commitment letter for a bridge loan facility (the Bridge Facility) and

recognized interest expense of $1.3 million related to this commitment during 2013. On January 29, 2014, we

entered into a bridge loan agreement (the Bridge Loan Agreement) with the Lenders party thereto and JP

Morgan Chase Bank, N.A., as administrative agent, pursuant to which the Lenders have agreed at closing of the

AT&T Transaction to provide to us an unsecured bridge loan facility for up to $1.9 billion for the purposes of

funding (i) substantially all of the purchase price for the AT&T Transaction and (ii) the fees and expenses

incurred in connection with the transactions contemplated by the stock purchase agreement for the AT&T

Transaction. Pursuant to the Bridge Loan Agreement, if and to the extent we do not, or are unable to, issue debt

securities yielding up to $1.9 billion in gross cash proceeds on or prior to the closing of the AT&T Transaction,

we shall draw down up to $1.9 billion, less the amount of the debt securities, if any, issued by us on or prior to

the closing of the AT&T Transaction, in aggregate principal amount of loans under the Bridge Facility to fund

the purchase price of the AT&T Transaction.

F-18

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements