Frontier Communications 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

constitutes effective internal control. We plan to adopt the 2013 Framework in 2014 and do not expect that it

will have a significant impact on the Company.

(3) The Transactions:

The 2010 Transaction

On July 1, 2010, the Company acquired the defined assets and liabilities of the local exchange business

and related landline activities of Verizon Communications Inc. (Verizon) in 14 states (the Acquired Territories),

including Internet access and long distance services and broadband video provided to designated customers in

the Acquired Territories (the 2010 Acquired Business). Frontier was considered the acquirer of the 2010

Acquired Business for accounting purposes.

The Company accounted for its acquisition of the 2010 Acquired Business (the 2010 Transaction) using

the guidance included in ASC Topic 805. We incurred $81.7 million and $143.1 million of integration related

costs in connection with the 2010 Transaction during the years ended December 31, 2012 and 2011,

respectively. Such costs are required to be expensed as incurred and are reflected in “Acquisition and

integration costs” in our consolidated statements of operations. All integration activities for the 2010

Transaction were completed as of the end of 2012.

The AT&T Transaction

On December 17, 2013, the Company announced that it entered into an agreement to acquire the wireline

properties of AT&T Inc. (AT&T) in Connecticut (the AT&T Transaction) for a purchase price of $2.0 billion in

cash, with adjustments for working capital. Upon completion of the AT&T Transaction, Frontier will operate

AT&T’s wireline business and fiber optic network that provides services to residential, commercial and

wholesale customers in Connecticut. The Company will also acquire AT&T’s U-versevideo and satellite TV

customers in Connecticut. We incurred $9.7 million of acquisition related costs in connection with the AT&T

Transaction during the fourth quarter of 2013.

(4) Accounts Receivable:

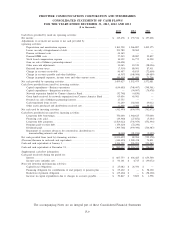

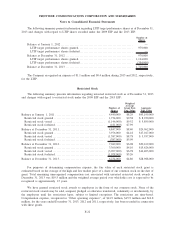

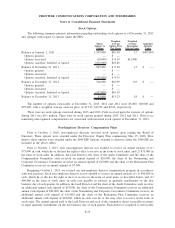

The components of accounts receivable, net at December 31, 2013 and 2012 are as follows:

($ in thousands) 2013 2012

Retail and Wholesale ........................................... $498,717 $581,152

Other .......................................................... 51,855 45,819

Less: Allowance for doubtful accounts . . ........................ (71,362) (93,267)

Accounts receivable, net . .................................. $479,210 $533,704

An analysis of the activity in the allowance for doubtful accounts for the years ended December 31, 2013,

2012 and 2011 is as follows:

($ in thousands)

Balance at

beginning of

Period

Charged to

Other Revenue

Charged (Credited) to

Switched and

Nonswitched Revenue

and Other Accounts

Write-offs and

Recoveries

Balance at end

of Period

2011 ...................... $ 73,571 $93,721 $16,403 $ (76,647) $107,048

2012 ...................... 107,048 74,332 14,396 (102,509) 93,267

2013 ...................... 93,267 68,965 (3,203) (87,667) 71,362

We maintain an allowance for doubtful accounts based on our estimate of our ability to collect accounts

receivable. The provision for uncollectible amounts was $65.8 million, $88.7 million and $110.1 million for the

years ended December 31, 2013, 2012 and 2011, respectively.

F-13

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements