Frontier Communications 2013 Annual Report Download - page 74

Download and view the complete annual report

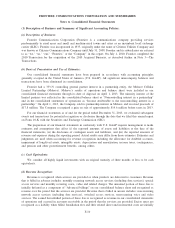

Please find page 74 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(i) Income Taxes and Deferred Income Taxes:

We file a consolidated federal income tax return. We utilize the asset and liability method of accounting

for income taxes. Under the asset and liability method, deferred income taxes are recorded for the tax effect of

temporary differences between the financial statement basis and the tax basis of assets and liabilities using tax

rates expected to be in effect when the temporary differences are expected to reverse.

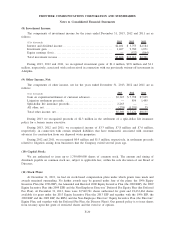

(j) Stock Plans:

We have various stock-based compensation plans. Awards under these plans are granted to eligible

officers, management employees, non-management employees and non-employee directors. Awards may be

made in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted

stock, restricted stock units or other stock-based awards, including awards with performance, market and time-

vesting conditions. Our general policy is to issue shares from treasury upon the grant of restricted shares,

earning of performance shares and the exercise of options.

The compensation cost recognized is based on awards ultimately expected to vest. U.S. GAAP requires

forfeitures to be estimated and revised, if necessary, in subsequent periods if actual forfeitures differ from those

estimates.

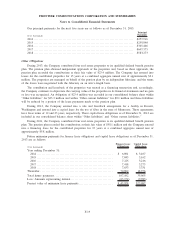

(k) Net Income Per Common Share Attributable to Common Shareholders:

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on, excluding unvested restricted stock awards. The impact of

dividends paid on unvested restricted stock awards have been deducted in the determination of basic and

diluted net income per common share attributable to common shareholders of Frontier. Except when the effect

would be antidilutive, diluted net income per common share reflects the dilutive effect of certain common stock

equivalents, as described further in Note 13—Net Income Per Common Share.

(2) Recent Accounting Literature:

Presentation of Comprehensive Income

In February 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update

No. 2013-02 (ASU 2013-02), “Comprehensive Income: Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income,” (Accounting Standards Codification (ASC) Topic 220). ASU

2013-02 requires disclosing the effect of reclassifications out of accumulated other comprehensive income on

the respective line items in the components of net income in circumstances when U.S. GAAP requires the item

to be reclassified in its entirety to net income. This new guidance is to be applied prospectively. The Company

adopted ASU 2013-02 during the fourth quarter of 2012 with no impact on our financial position, results of

operations or cash flows.

Internal Control—Integrated Framework

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO)

issued its updated Internal Control—Integrated Framework (the 2013 Framework) and related illustrative

documents. COSO will continue to make available its original Framework during the transition period

extending to December 15, 2014. The Company currently utilizes COSO’s original Framework, which was

published in 1992 and is recognized as the leading guidance for designing, implementing and conducting

internal controls over external financial reporting and assessing its effectiveness. The 2013 Framework is

expected to help organizations design and implement internal control in light of many changes in business and

operating environments since the issuance of the original Framework, broaden the application of internal

control in addressing operations and reporting objectives, and clarify the requirements for determining what

F-12

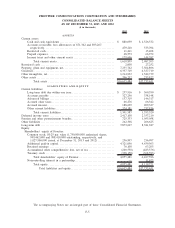

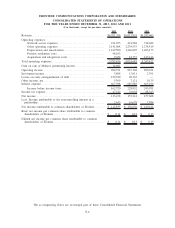

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements