Frontier Communications 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

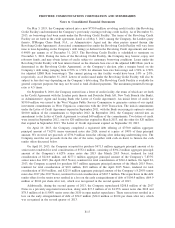

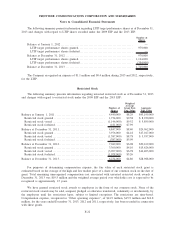

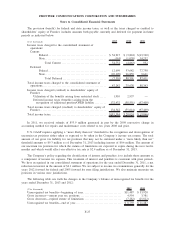

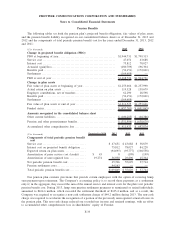

Stock Options

The following summary presents information regarding outstanding stock options as of December 31, 2013

and changes with regard to options under the EIPs:

Shares

Subject to

Option

Weighted

Average

Option Price

Per Share

Weighted

Average

Remaining

Life in Years

Aggregate

Intrinsic

Value

Balance at January 1, 2011 ............................ 1,507,000 $10.50 1.7 $603,000

Options granted ..................................... — $ —

Options exercised . . ................................. (10,000) $ 8.19 $12,000

Options canceled, forfeited or lapsed . . ............... (602,000) $10.86

Balance at December 31, 2011 . ........................ 895,000 $ 9.94 1.3 $ —

Options granted ..................................... — $ —

Options exercised . . ................................. — $ —

Options canceled, forfeited or lapsed . . ............... (355,000) $ 8.35

Balance at December 31, 2012 . ........................ 540,000 $10.99 0.9 $ —

Options granted ..................................... — $ —

Options exercised . . ................................. — $ —

Options canceled, forfeited or lapsed . . ............... (457,000) $10.59

Balance at December 31, 2013 . ........................ 83,000 $13.23 1.8 $ —

The number of options exercisable at December 31, 2013, 2012 and 2011 were 83,000, 540,000 and

895,000, with a weighted average exercise price of $13.23, $10.99 and $9.94, respectively.

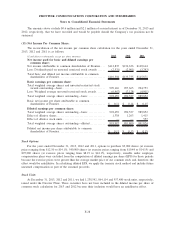

There were no stock options exercised during 2013 and 2012. Cash received upon the exercise of options

during 2011 was $0.1 million. There were no stock options granted during 2013, 2012 and 2011. There is no

remaining unrecognized compensation cost associated with unvested stock options at December 31, 2013.

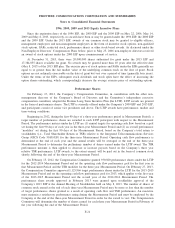

Non-Employee Directors’ Compensation Plans

Prior to October 1, 2010, non-employee directors received stock options upon joining the Board of

Directors. These options were awarded under the Directors’ Equity Plan commencing May 25, 2006. Prior

thereto, these options were awarded under the 2000 EIP. Options awarded to directors under the 2000 EIP are

included in the above tables.

Prior to October 1, 2013, each non-employee director was entitled to receive an annual retainer of (1)

$75,000 in cash, which he or she had the right to elect to receive in the form of stock units, and (2) $75,000 in

the form of stock units. In addition, the Lead Director, the chair of the Audit Committee and the chair of the

Compensation Committee each received an annual stipend of $20,000, the chair of the Nominating and

Corporate Governance Committee received an annual stipend of $10,000 and the chair of the Retirement Plan

Committee received an annual stipend of $7,500.

Beginning October 1, 2013, we revised our non-employee director compensation program in accordance

with best practices. Each non-employee director is now entitled to receive an annual retainer of (1) $90,000 in

cash, which he or she has the right to elect to receive in the form of stock units, as described below, and (2)

$90,000 in the form of stock units, in each case payable in advance in quarterly installments on the first

business day of each quarter. In addition, the Lead Director and the chair of the Audit Committee each receives

an additional annual cash stipend of $25,000, the chair of the Compensation Committee receives an additional

annual cash stipend of $20,000, the chair of the Nominating and Corporate Governance Committee receives an

additional annual cash stipend of $15,000 and the chair of the Retirement Plan Committee receives an

additional annual cash stipend of $10,000, which in each case he or she may elect to receive in the form of

stock units. The annual stipend paid to the Lead Director and each of the committee chairs is payable in arrears

in equal quarterly installments on the last business day of each quarter. Each director is required to irrevocably

F-23

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements