Frontier Communications 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For the year ended December 31, 2013, we generated revenue of $4.8 billion, including customer

revenue of $4.2 billion and regulatory revenue of $0.6 billion, and net cash provided by operating

activities of $1.5 billion. We have a well-balanced debt maturity schedule and we have available

liquidity of over $1.6 billion as of December 31, 2013, comprised of cash and available credit on our

$750.0 million revolving credit facility.

Our operating results, prudent capital investments, and expense management provided a strong cash

flow base and a solid financial platform for investing in the business, servicing our debt and maintaining

our dividend payout.

•The AT&T Transaction

On December 17, 2013, the Company announced that it entered into an agreement to acquire the

wireline properties of AT&T Inc. (AT&T) in Connecticut for a purchase price of $2.0 billion in cash

(the AT&T Transaction). Upon completion of the AT&T Transaction, we will operate AT&T’s wireline

business that provides services to residential, commercial and wholesale customers in Connecticut,

making Connecticut the Company’s largest market. We will also acquire AT&T’s U-versevideo and

satellite TV customers in Connecticut. As of the date of the announcement, this business had

approximately 900,000 voice, 415,000 broadband, and 180,000 video connections. The AT&T

Transaction is expected to close in the second half of 2014.

Communications Services

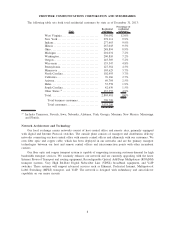

As of December 31, 2013, we are the nation’s fourth largest Incumbent Local Exchange Carrier (ILEC),

with 3.1 million customers, 1.9 million broadband connections and 13,650 employees. We operate as an ILEC

in 27 states and will also operate in Connecticut after consummation of the AT&T Transaction.

We conduct business with both residential and business customers, and we provide the “last mile” of

communications services to customers in these markets. During 2013, our customer revenue was $4,209.9

million, including residential revenue of $2,029.5 million and business revenue of $2,180.5 million. At

December 31, 2013, we had 1,866,700 broadband subscribers and 385,400 video subscribers. Our services and

products include:

•data and Internet services

– wireline broadband services

– data transmission services (e.g., DS1, DS3, OCNX, Ethernet, dedicated Internet Protocol)

– wireless broadband services

– computer security and premium technical support (i.e., Frontier Secure)

– commercial Voice over Internet Protocol (VoIP) service

•local and long distance voice services

– local voice services

– enhanced services (e.g., voicemail, call waiting)

– long distance network services

•access services

•other services

– satellite and terrestrial video

– customer premise equipment

– directories

Company Strategies

The key elements of our strategy are as follows:

3

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES