Frontier Communications 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Presentation of Comprehensive Income

In February 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update

No. 2013-02 (ASU 2013-02), “Comprehensive Income: Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income,” (ASC Topic 220). ASU 2013-02 requires disclosing the effect

of reclassifications out of accumulated other comprehensive income on the respective line items in the

components of net income in circumstances when U.S. GAAP requires the item to be reclassified in its entirety

to net income. This new guidance was to be applied prospectively. The Company adopted ASU 2013-02 during

the fourth quarter of 2012 with no impact on our financial position, results of operations or cash flows.

Internal Control—Integrated Framework

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO)

issued its updated Internal Control—Integrated Framework (the 2013 Framework) and related illustrative

documents. COSO will continue to make available its original Framework during the transition period

extending to December 15, 2014. The Company currently utilizes COSO’s original Framework, which was

published in 1992 and is recognized as the leading guidance for designing, implementing and conducting

internal controls over external financial reporting and assessing its effectiveness. The 2013 Framework is

expected to help organizations design and implement internal control in light of many changes in business and

operating environments since the issuance of the original Framework, broaden the application of internal

control in addressing operations and reporting objectives, and clarify the requirements for determining what

constitutes effective internal control. We plan to adopt the 2013 Framework in 2014 and do not expect that it

will have a significant impact on the Company.

(b) Results of Operations

REVENUE

Revenue is generated primarily through the provision of voice services, data services, video services,

network access, carrier services and other Internet services. Such revenues are generated through either a

monthly recurring fee or a fee based on usage, and revenue recognition is not dependent upon significant

judgments by management, with the exception of a determination of a provision for uncollectible amounts.

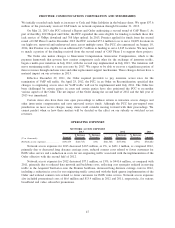

Revenue for 2013 decreased $250.3 million, or 5%, to $4,761.6 million as compared to 2012. The decline

in 2013 is primarily the result of decreases in voice revenues and lower switched and nonswitched access

revenue, partially offset by an increase in data services revenue, each as described in more detail below.

Additionally, wireless revenue decreased by $32.4 million in 2013 due to the sale of our Mohave Cellular

Limited Partnership (Mohave) interest on April 1, 2013.

Switched access and subsidy revenue of $551.6 million represented 12% of our revenues for 2013.

Switched access revenue was $234.5 million in 2013, or 5% of our revenues, down from $282.3 million, or 6%

of our revenues, for 2012. Subsidy revenue was $317.1 million in 2013, or 7% of our revenues, down slightly

from $324.6 million, or 6% of our revenues, in 2012. We expect declining revenue trends in switched access

and subsidy revenue to continue in 2014.

Revenue for 2012 decreased $231.2 million, or 4%, to $5,011.9 million as compared to 2011. The decline

in 2012 was primarily the result of decreases in the number of business and residential customers and switched

access revenue, partially offset by an increase in subsidies revenue, each as described in more detail below.

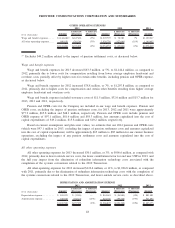

During 2013, we lost 98,900 customers, as compared to a loss of 240,500 customers in 2012 and 375,400

customers in 2011. We believe the improved customer retention in 2013 as compared to prior years is

principally due to our investments in our network, our local engagement strategy, improved customer service

and simplified products and pricing.

Average monthly residential revenue per customer (residential ARPC) increased $0.97, or 2%, to $59.30

during 2013 as compared to 2012. Total residential revenue for the year ended December 31, 2013 declined

$99.4 million, or 5%, as compared to the year ended December 31, 2012, primarily as a result of decreases in

local voice and long distance revenues and the sale of our interest in the Mohave partnership, partially offset by

42

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES