Frontier Communications 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

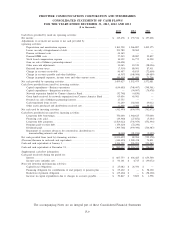

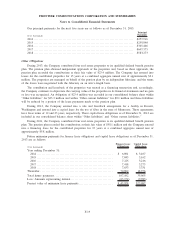

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2013, 2012 AND 2011

($ in thousands)

2013 2012 2011

Cash flows provided by (used in) operating activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 115,478 $ 153,314 $ 157,608

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,169,500 1,266,807 1,403,175

Losses on early extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159,780 90,363 —

Pension settlement costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44,163 — —

Pension/OPEB costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,243 28,087 23,897

Stock based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,932 16,775 14,209

Gain on sale of Mohave partnership interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,601) — —

Other non-cash adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,065 10,319 (28,036)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,510) 80,501 87,411

Change in accounts receivable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50,487 43,813 (72,600)

Change in accounts payable and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,507) (148,906) (84,689)

Change in prepaid expenses, income taxes and other current assets . . . . . . . . . . . . . (80,403) 11,400 71,706

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,495,627 1,552,473 1,572,681

Cash flows provided from (used by) investing activities:

Capital expenditures—Business operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (634,685) (748,407) (748,361)

Capital expenditures—Integration activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (54,097) (76,478)

Network expansion funded by Connect America Fund . . . . . . . . . . . . . . . . . . . . . . . . . (32,748) (4,830) —

Grant funds received for network expansion from Connect America Fund . . . . . . 63,636 65,981 —

Proceeds on sale of Mohave partnership interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,755 — —

Cash transferred from escrow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31,249 102,020 43,012

Other assets purchased and distributions received, net. . . . . . . . . . . . . . . . . . . . . . . . . . 12,300 4,394 19,155

Net cash used by investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (542,493) (634,939) (762,672)

Cash flows provided from (used by) financing activities:

Long-term debt borrowings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 750,000 1,360,625 575,000

Financing costs paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (19,360) (27,852) (5,444)

Long-term debt payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,563,022) (756,953) (552,394)

Premium paid to retire debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (159,429) (72,290) —

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (399,768) (399,390) (746,387)

Repayment of customer advances for construction, distributions to

noncontrolling interests and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,048) (21,236) (5,953)

Net cash provided from (used by) financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,399,627) 82,904 (735,178)

(Decrease)/Increase in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (446,493) 1,000,438 74,831

Cash and cash equivalents at January 1, . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,326,532 326,094 251,263

Cash and cash equivalents at December 31, . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 880,039 $1,326,532 $ 326,094

Supplemental cash flow information:

Cash paid (received) during the period for:

Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 667,753 $ 636,485 $ 653,500

Income taxes (refunds), net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 94,161 $ 4,715 $ (33,072)

Non-cash investing and financing activities:

Capital lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25,082 $ 26,596 $ —

Financing obligation for contributions of real property to pension plan . . . . . . . . . $ 23,422 $ — $ 58,100

Reduction of pension obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (23,422) $ — $ (58,100)

Increase in capital expenditures due to changes in accounts payable . . . . . . . . . . . . $ 39,847 $ 9,802 $ 1,338

The accompanying Notes are an integral part of these Consolidated Financial Statements

F-9