Frontier Communications 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

services. Integrating these services with other services may provide the opportunity to capture an increased

percentage of our customers’ total communications expenditures.

Access services. Our switched access services allow other carriers to use our facilities to originate and

terminate their local and long distance voice traffic. These services are generally offered on a month-to-month

basis and the service is billed primarily on a minutes-of-use basis. Switched access charges have been based on

access rates filed with the FCC for interstate services and with the respective state regulatory agency for

intrastate services. On November 18, 2011, the FCC released the USF/ICC Report & Order (the Order) that,

beginning in July 2012, requested that we transition to terminating switched access rates over time to near zero

by July 2017. The Order enables companies to recover part of the decline through increases in subscriber line

fees charged to some residential and business wireline voice customers. While the FCC has asserted jurisdiction

over these terminating access rates, during the transition the charges will continue to be based on tariffs filed

with both the FCC and state regulatory agencies. Monthly recurring access service fees are billed in advance.

We also receive subsidies from state and federal authorities based on the higher cost of providing wireline

service to certain rural areas that are included in our access services revenue. Beginning in July 2012, the

Company began receiving federal subsidies for the deployment of broadband in unserved and high-cost areas.

Video services. We have offered video services under an exclusive agency relationship with DISH since

August 2011. We receive from DISH, and recognize as revenue, activation fees, other residual fees and

nominal management, billing and collection fees. Additionally, we offer fiber optic-based video services on a

limited basis in the states of Indiana, Oregon and Washington pursuant to franchises, permits and similar

authorizations issued by local franchising authorities.

Customer Premise Equipment. We offer our small, medium and enterprise business customers a wide

range of third-party communications equipment tailored to their specific business needs. Equipment sales are

most often sold in conjunction with a variety of voice, data and Internet services; however, equipment may also

be sold on a standalone basis. We recognize revenue for these equipment sales in accordance with the contracts,

and separately from any related maintenance agreements, generally at time of installation and acceptance by

our customers.

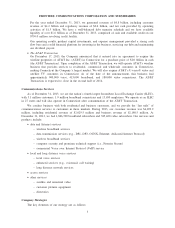

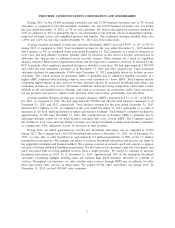

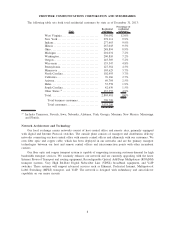

Customer Metrics

Our Company, like others in the industry, utilizes reporting metrics focused on units. Consistent with our

strategy to focus on the customer, we also utilize residential and business customer metrics that, when

combined with unit counts, provide additional insight into the results of our strategic initiatives described

above.

2013 2012

As of or for the year ended

December 31,

Residential Customer Metrics:

Customers......................................................... 2,803,481 2,887,063

Revenue (in 000’s) ................................................ $2,029,479 $2,128,859

Average monthly residential revenue per customer(1) ................. $ 59.30 $ 58.33

Customer monthly churn . . ......................................... 1.69% 1.62%

Business Customer Metrics:

Customers......................................................... 270,799 286,106

Revenue (in 000’s) ................................................ $2,180,456 $2,276,119

Average monthly business revenue per customer .................... $ 653.26 $ 639.13

Total customers...................................................... 3,074,280 3,173,169

Broadband subscribers................................................ 1,866,670 1,754,422

Video subscribers . . .................................................. 385,353 346,627

(1) Calculation excludes the Mohave Cellular Limited Partnership which was sold as of April 1, 2013.

6

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES