Frontier Communications 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

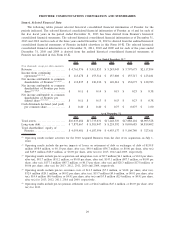

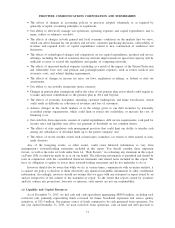

Item 6. Selected Financial Data

The following tables present selected historical consolidated financial information of Frontier for the

periods indicated. The selected historical consolidated financial information of Frontier as of and for each of

the five fiscal years in the period ended December 31, 2013 has been derived from Frontier’s historical

consolidated financial statements. The selected historical consolidated financial information as of December 31,

2013 and 2012 and for each of the three years ended December 31, 2013 is derived from the audited historical

consolidated financial statements of Frontier included elsewhere in this Form 10-K. The selected historical

consolidated financial information as of December 31, 2011, 2010 and 2009 and for each of the years ended

December 31, 2010 and 2009 is derived from the audited historical consolidated financial statements of

Frontier not included in this Form 10-K.

2013 2012 2011 2010 2009

Year Ended December 31,(1)

($ in thousands, except per share amounts)

Revenue . . . ....................... $ 4,761,576 $ 5,011,853 $ 5,243,043 $ 3,797,675 $2,117,894

Income from continuing

operations(2)(3)(4)(5) ................ $ 115,478 $ 153,314 $ 157,608 $ 155,717 $ 123,181

Net income attributable to common

shareholders of Frontier(2)(3)(4)(5) . . . $ 112,835 $ 136,636 $ 149,614 $ 152,673 $ 120,783

Net income attributable to common

shareholders of Frontier per basic

share(2)(3)(4)(5) .................... $ 0.11 $ 0.14 $ 0.15 $ 0.23 $ 0.38

Net income attributable to common

shareholders of Frontier per

diluted share(2)(3)(4)(5) ............. $ 0.11 $ 0.13 $ 0.15 $ 0.23 $ 0.38

Cash dividends declared (and paid)

per common share. . ............. $ 0.40 $ 0.40 $ 0.75 $ 0.875 $ 1.00

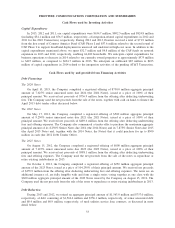

2013 2012 2011 2010 2009

As of December 31,

Total assets ....................... $16,635,484 $17,733,631 $17,448,319 $17,888,101 $6,903,528

Long-term debt.................... $ 7,873,667 $ 8,381,947 $ 8,224,392 $ 8,005,685 $4,819,402

Total shareholders’ equity of

Frontier. . ....................... $ 4,055,481 $ 4,107,596 $ 4,455,137 $ 5,196,740 $ 327,611

(1) Operating results include activities for the 2010 Acquired Business from the date of its acquisition on July 1,

2010.

(2) Operating results include the pre-tax impacts of losses on retirement of debt or exchanges of debt of $159.8

million ($98.9 million, or $0.10 per share, after tax), $90.4 million ($56.7 million, or $0.06 per share, after tax)

and $45.9 million ($28.9 million, or $0.09 per share, after tax) for 2013, 2012 and 2009, respectively.

(3) Operating results include pre-tax acquisition and integration costs of $9.7 million ($6.1 million, or $0.01 per share,

after tax), $81.7 million ($51.2 million, or $0.05 per share, after tax), $143.1 million ($87.3 million, or $0.09 per

share, after tax), $137.1 million ($85.7 million, or $0.13 per share, after tax) and $28.3 million ($17.8 million, or

$0.06 per share, after tax) for 2013, 2012, 2011, 2010 and 2009, respectively.

(4) Operating results include pre-tax severance costs of $11.5 million ($7.3 million, or $0.01 per share, after tax),

$32.0 million ($20.1 million, or $0.02 per share, after tax), $15.7 million ($9.6 million, or $0.01 per share, after

tax), $10.4 million ($6.4 million, or $0.01 per share, after tax) and $3.8 million ($2.4 million, or $0.01 per share,

after tax) for 2013, 2012, 2011, 2010 and 2009, respectively.

(5) Operating results include pre-tax pension settlement costs of $44.2 million ($27.4 million, or $0.03 per share, after

tax) for 2013.

29

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES