Frontier Communications 2013 Annual Report Download - page 8

Download and view the complete annual report

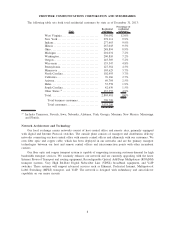

Please find page 8 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2013, we lost 83,600 residential customers, net, and 15,300 business customers, net, or 3% of total

customers, as compared to 216,700 residential customers, net, and 23,800 business customers, net, lost during

the year ended December 31, 2012, or 7% of total customers. We believe the improved customer retention in

2013 as compared to 2012 is principally due to our investments in our network, our local engagement strategy,

improved customer service and simplified products and bundles. Our residential customer monthly churn was

1.69% and 1.62% for the years ended December 31, 2013 and 2012 respectively.

Average monthly residential revenue per customer (residential ARPC) increased $0.97, or 2%, to $59.30

during 2013 as compared to 2012. Total residential revenue for the year ended December 31, 2013 declined

$99.4 million, or 5%, as compared to the year ended December 31, 2012 primarily as a result of decreases in

local voice and long distance revenues, partially offset by increases in data services revenue and increases in

subscriber line charges due to additional access recovery charges. These charges are a result of regulatory

changes related to Intercarrier Compensation reform and are expected to continue to increase, as allowed by the

FCC to partially offset regulatory mandated declines in switched access rates. We had approximately 2,803,500

and 2,887,100 total residential customers as of December 31, 2013 and 2012, respectively. Total residential

customers declined by approximately 83,600 since December 31, 2012, principally driven by declines in voice

customers. The overall increase in residential ARPC is primarily due to additional bundled customers at a

higher ARPC combined with declining counts in voice-only customers at a lower ARPC. The Company expects

continuing improvements in data services revenue, primarily driven by increased broadband subscribers, and

continuing declines in voice services. Economic conditions and/or increasing competition could make it more

difficult to sell our bundled service offerings, and cause us to increase our promotions and/or lower our prices

for our products and services, which would adversely affect our revenue, profitability and cash flows.

Average monthly business revenue per customer (business ARPC) increased $14.13, or 2%, to $653.26,

for 2013, as compared to 2012. We had approximately 270,800 and 286,100 total business customers as of

December 31, 2013 and 2012, respectively. Total business revenue for the year ended December 31, 2013

declined $95.7 million, or 4%, as compared to the year ended December 31, 2012, principally as a result of

decreases in our local and long distance revenues and wireless backhaul. Total business customers declined by

approximately 15,300 since December 31, 2012. The overall increase in business ARPC is primarily due to

declining customer counts for our small business customers that carry a lower ARPC. The Company expects

the declines in local voice and long distance revenues and wireless backhaul revenues from business customers

to continue into 2014, mitigated, in part, by increases in data revenues.

During 2013, we added approximately 112,250 new broadband subscribers, net, as compared to 23,400

during 2012. The Company had 1,866,700 broadband subscribers at December 31, 2013. As of December 31,

2013, we were able to offer broadband to approximately 6.4 million households, or 90% of the 7.1 million

households in our territory. We continue our efforts to increase broadband subscribers and increase our share of

the applicable residential and business markets. We continue to invest in network speed and capacity to support

our goal of driving additional broadband penetration. We also believe our customers value the convenience and

price associated with receiving multiple services from a single provider. We expect to continue to increase

broadband subscribers in 2014. As of December 31, 2013, approximately 76% of our residential broadband

customers, (excluding multiple dwelling units and wireless high speed Internet), subscribe to a bundle of

services. Throughout our territories, we offer satellite video services through DISH and, in addition, we offer

fiber optic-based video services in three states. We gained 38,700 video subscribers, net during 2013. At

December 31, 2013, we had 385,400 video customers.

7

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES