Frontier Communications 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

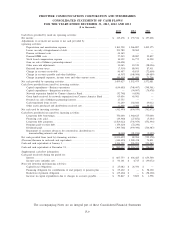

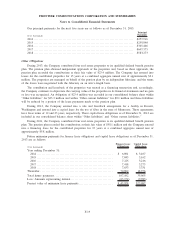

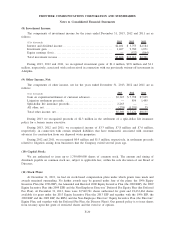

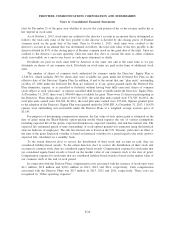

(5) Property, Plant and Equipment:

Property, plant and equipment, net at December 31, 2013 and 2012 are as follows:

($ in thousands)

Estimated

Useful Lives 2013 2012

Land ...................................................... N/A $ 126,483 $ 126,483

Buildings and leasehold improvements . . . ................... 41 years 1,061,097 1,052,650

General support ............................................ 5 to 17 years 977,941 988,707

Central office/electronic circuit equipment ................... 5 to 11 years 5,222,928 4,965,099

Poles ...................................................... 49 years 549,322 507,922

Cable and wire............................................. 15 to 30 years 6,259,292 6,038,835

Conduit.................................................... 60 years 359,974 354,777

Other ...................................................... 12 to 30 years 43,144 44,802

Construction work in progress . . ............................ 250,516 274,488

Property, plant and equipment . . ............................ 14,850,697 14,353,763

Less: Accumulated depreciation . ............................ (7,594,935) (6,848,867)

Property, plant and equipment, net .......................... $ 7,255,762 $ 7,504,896

Depreciation expense is principally based on the composite group method. Depreciation expense was

$841.5 million, $844.6 million and $881.5 million for the years ended December 31, 2013, 2012 and 2011,

respectively. As a result of an independent study of the estimated remaining useful lives of our plant assets, we

adopted new estimated remaining useful lives for certain plant assets as of October 1, 2013, with an immaterial

impact to depreciation expense.

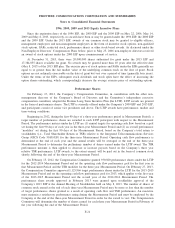

(6) Goodwill and Other Intangibles:

The components of goodwill by the reporting units in effect as of December 31, 2013 are as follows:

($ in thousands)

Central .................................................................. $1,815,498

East..................................................................... 2,003,574

National. . . .............................................................. 1,218,113

West .................................................................... 1,300,534

Total Goodwill. ..................................................... $6,337,719

The components of other intangibles at December 31, 2013 and 2012 are as follows:

($ in thousands)

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

2013 2012

Other Intangibles:

Customer base. . . ...... $2,427,648 $(1,336,852) $1,090,796 $2,427,648 $(1,009,045) $1,418,603

Software licenses ...... — — — 105,019 (105,019) —

Trade name and

license.............. 124,136 — 124,136 124,419 (283) 124,136

Total other

intangibles . . ...... $2,551,784 $(1,336,852) $1,214,932 $2,657,086 $(1,114,347) $1,542,739

Amortization expense was $328.0 million, $422.2 million and $521.7 million for the years ended

December 31, 2013, 2012 and 2011, respectively. Amortization expense for 2013, 2012 and 2011 of $328.0

million, $410.8 million and $465.4 million, respectively, mainly represents the amortization of intangible assets

(primarily customer base) that were acquired in the 2010 Transaction based on a useful life of nine years for

the residential customer base and 12 years for the business customer base, amortized on an accelerated method.

Amortization expense for 2012 and 2011 included $38.3 million and $49.1 million, respectively, for

F-14

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements