Frontier Communications 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amortization was based on an estimated useful life of five years on the straight-line method. We periodically

reassess the useful life of our intangible assets to determine whether any changes to those lives are required.

We anticipate depreciation expense of approximately $800 million to $820 million and amortization

expense of approximately $285 million for 2014 for our current business operations.

Pension and Other Postretirement Benefits

Our estimates of pension expense, other postretirement benefits (OPEB), including retiree medical

benefits, and related liabilities, are “critical accounting estimates.” We sponsor a noncontributory defined

benefit pension plan covering a significant number of our current and former employees and other

postretirement benefit plans that provide medical, dental, life insurance and other benefits for covered retired

employees and their beneficiaries and covered dependents. All of the employees who are still accruing pension

benefits are employees represented by unions. Pension and other postretirement benefit costs and obligations

are dependent upon various actuarial assumptions applied in the determination of such amounts. These actuarial

assumptions include the following: discount rates, expected long-term rate of return on plan assets, future

compensation increases, employee turnover, healthcare cost trend rates, expected retirement age, optional form

of benefit and mortality. We review these assumptions for changes annually with our independent actuaries.

The assumptions for our discount rate and expected long-term rate of return on plan assets are considered to

have the most significant impact on pension costs and funding levels.

The discount rate is used to value, on a present value basis, our pension and OPEB liabilities as of the

balance sheet date. The same rate is also used in the interest cost component of the pension and postretirement

benefit cost determination for the following year. The measurement date used in the selection of our discount

rate is the balance sheet date. Our discount rate assumption is determined annually with assistance from our

actuaries based on the pattern of expected future benefit payments and the prevailing rates available on long-

term, high quality corporate bonds with durations approximate to that of our benefit obligation. As of

December 31, 2013 and 2012, we utilized an estimation technique that is based upon a settlement model

(Bond:Link) that permits us to closely match cash flows to the expected payments to participants. This rate can

change from year-to-year based on market conditions that affect corporate bond yields.

In determining the discount rate as of December 31, 2011, we considered, among other things, the yields

on the Citigroup Above Median Pension Curve, the Towers Watson Index, the general movement of interest

rates and the changes in those rates from one period to the next.

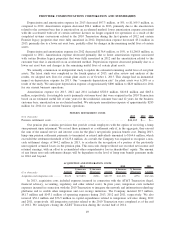

We are utilizing a discount rate of 4.90% as of December 31, 2013 for our qualified pension plan,

compared to rates of 4.00% and 4.50% in 2012 and 2011, respectively. The discount rate for postretirement

plans as of December 31, 2013 was a range of 4.90% to 5.20% compared to a range of 4.00% to 4.20% in 2012

and 4.50% to 4.75% in 2011.

The expected long-term rate of return on plan assets is applied in the determination of periodic pension

and postretirement benefit cost as a reduction in the computation of the expense. In developing the expected

long-term rate of return assumption, we considered published surveys of expected market returns, 10 and 20

year actual returns of various major indices, and our own historical 5 year, 10 year and 20 year investment

returns. The expected long-term rate of return on plan assets is based on an asset allocation assumption of 35%

to 55% in fixed income securities, 35% to 55% in equity securities and 5% to 15% in alternative investments.

We review our asset allocation at least annually and make changes when considered appropriate. Our asset

return assumption is made at the beginning of our fiscal year. In 2011, 2012 and 2013, our expected long-term

rate of return on plan assets was 8.00%, 7.75% and 8.00%, respectively. Our actual return on plan assets in

2013 was 10.9%. For 2014, we will assume a rate of return of 7.75%. Our pension plan assets are valued at fair

value as of the measurement date.

We expect that our pension and other postretirement benefit expenses for 2014 will be approximately $65

million to $85 million before amounts capitalized into the cost of capital expenditures and the impact of

pension settlement costs. In 2013, our pension and OPEB expenses were $97.1 million before amounts

capitalized into the cost of capital expenditures and the impact of pension settlement costs. We expect to make

contributions to our pension plan of approximately $100 million in 2014. We made total contributions to our

pension plan during 2013 of $62.3 million, consisting of cash payments of $38.9 million and the contribution of

40

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES