Frontier Communications 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

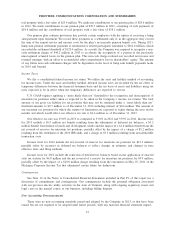

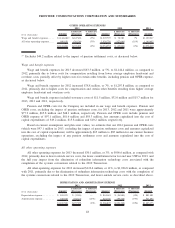

GAIN ON SALE OF MOHAVE PARTNERSHIP INTEREST

($ in thousands) 2013 2012 2011

Gain on sale of Mohave partnership interest . . . . . . . . . . . . . ................................................ $14,601 $— $—

On April 1, 2013, the Company sold its 33

1

⁄

3

% interest in the Mohave partnership, in which Frontier was

the General Partner. The Company received proceeds on sale of $17.8 million and recognized a gain on sale of

$14.6 million before taxes in the second quarter of 2013.

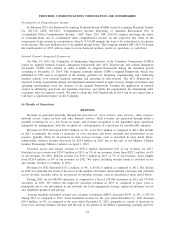

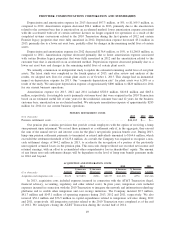

INVESTMENT INCOME / LOSSES ON EARLY EXTINQUISHMENT OF DEBT / OTHER

INCOME, NET / INTEREST EXPENSE / INCOME TAX EXPENSE

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2013 2012 2011

Investment income ................... $ 3,808 $ (9,203) (71%) $ 13,011 $ 10,620 NM $ 2,391

Losses on early extinguishment

of debt . . . . . . . . . ................... $159,780 $ 69,417 77% $ 90,363 $ 90,363 100% $ —

Other income, net . ................... $ 5,369 $ (1,752) (25%) $ 7,121 $ (2,014) (22%) $ 9,135

Interest expense . . . ................... $667,398 $(20,587) (3%) $687,985 $ 22,789 3% $665,196

Income tax expense . . . . . . . . . . . . . . . . . . $ 47,242 $(28,396) (38%) $ 75,638 $(12,705) (14%) $ 88,343

Investment Income

Investment income for 2013 decreased $9.2 million to $3.8 million, as compared with 2012, primarily due

to the $1.4 million in investment gains associated with cash received during 2013, as compared to $9.8 million

in 2012, in connection with our previously written-off investment in Adelphia.

Investment income for 2012 increased $10.6 million to $13.0 million, as compared with 2011, primarily

due to $9.8 million in investment gains associated with cash received during 2012 in connection with our

previously written-off investment in Adelphia.

Our average cash balances were $858.4 million, $705.6 million and $275.0 million for 2013, 2012 and

2011, respectively. Our average total restricted cash balances were $28.1 million, $105.9 million and $170.5

million for 2013, 2012 and 2011, respectively.

Losses on Early Extinguishment of Debt

Losses on early extinguishment of debt for 2013 increased $69.4 million to $159.8 million, as compared

with 2012.

In 2013, we recognized losses of $104.9 million on the early extinguishment of debt from debt tender

offers that resulted in the retirement of $194.9 million of the March 2015 Notes, $277.9 million of the April

2015 Notes and $225.0 million of the 2017 Notes. Additionally, we recognized losses of $54.9 million for

$208.8 million in privately negotiated repurchases of our 2017 Notes and for $17.3 million and $78.5 million in

open market repurchases of our 8.125% senior notes due 2018 and 8.500% senior notes due 2020, respectively.

During 2012, we recognized losses of $90.4 million on the early extinguishment of debt, comprised of

$69.0 million in connection with a $500.0 million debt tender offer for the Notes, a loss of $2.1 million for

$78.1 million in open market repurchases of our 6.25% Senior Notes due 2013 and a loss of $19.3 million for

open market repurchases of $75.7 million of the April 2015 Notes and $59.3 million of the 2017 Notes.

Other Income, Net

Other income, net for 2013 decreased $1.8 million to $5.4 million, as compared with 2012, primarily due

to a decrease of $4.5 million in the settlement of customer advances, partially offset by proceeds of $2.3

million in the settlement of a split-dollar life insurance policy for a former senior executive during 2013.

Other income, net for 2012 decreased $2.0 million to $7.1 million, as compared with 2011.

50

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES