Frontier Communications 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Covenants

The terms and conditions contained in our indentures, the Credit Agreement, the Revolving Credit

Agreement and the Bridge Loan Agreement include the timely payment of principal and interest when due, the

maintenance of our corporate existence, keeping proper books and records in accordance with U.S. GAAP,

restrictions on the incurrence of liens on our assets, and restrictions on asset sales and transfers, mergers and

other changes in corporate control. We are not subject to restrictions on the payment of dividends either by

contract, rule or regulation, other than that imposed by the General Corporation Law of the State of Delaware.

However, we would be restricted under the Credit Agreement, the Revolving Credit Agreement and the Bridge

Loan Agreement from declaring dividends if an event of default occurred and was continuing at the time or

would result from the dividend declaration.

The Credit Agreement and the Revolving Credit Agreement each contain a maximum leverage ratio

covenant. Under those covenants, we are required to maintain a ratio of (i) total indebtedness minus cash and

cash equivalents (including restricted cash) in excess of $50.0 million to (ii) consolidated adjusted EBITDA (as

defined in the agreements) over the last four quarters not to exceed 4.50 to 1.

The Credit Agreement, the Revolving Credit Agreement, the Bridge Loan Agreement and certain

indentures for our senior unsecured debt obligations limit our ability to create liens or merge or consolidate

with other companies and our subsidiaries’ ability to borrow funds, subject to important exceptions and

qualifications.

As of December 31, 2013, we were in compliance with all of our debt and credit facility covenants.

Dividends

We currently intend to pay regular quarterly dividends. Our ability to fund a regular quarterly dividend

will be impacted by our ability to generate cash from operations. The declarations and payment of future

dividends is at the discretion of our Board of Directors, and will depend upon many factors, including our

financial condition, results of operations, growth prospects, funding requirements, applicable law, restrictions in

agreements governing our indebtedness and other factors our Board of Directors deem relevant.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationships

with unconsolidated entities that would be expected to have a material current or future effect upon our

financial statements.

Future Contractual Obligations and Commitments

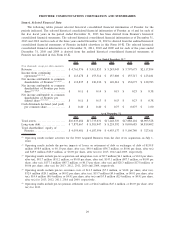

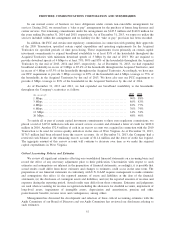

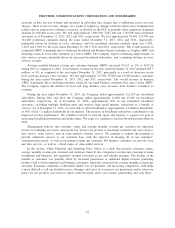

A summary of our future contractual obligations and commercial commitments as of December 31, 2013

is as follows:

($ in thousands) Total 2014

2015 and

2016

2017 and

2018 Thereafter

Payments due by period

Long-term debt obligations,

excluding interest ................... $ 8,129,546 $ 257,916 $ 605,306 $1,190,648 $6,075,676

Interest on long-term debt . . . .......... 6,246,760 630,393 1,215,783 1,108,706 3,291,878

Operating lease obligations . . .......... 145,328 61,880 19,256 15,101 49,091

Capital lease obligations............... 35,065 3,107 6,378 6,604 18,976

Financing lease obligations . . .......... 107,102 6,891 14,268 15,051 70,892

Purchase obligations .................. 70,642 28,653 30,490 5,499 6,000

“Take or pay” contract obligations ..... 286,300 145,500 140,800 — —

Liability for uncertain tax positions . . . . 9,329 2,840 3,886 2,603 —

Total ............................ $15,030,072 $1,137,180 $2,036,167 $2,344,212 $9,512,513

At December 31, 2013, we had outstanding performance letters of credit totaling $46.8 million.

36

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES