Frontier Communications 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

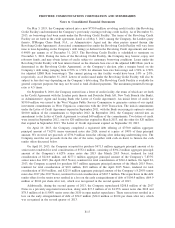

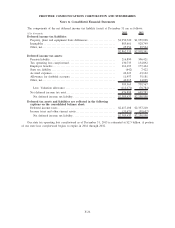

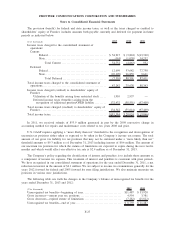

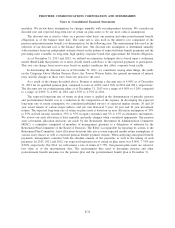

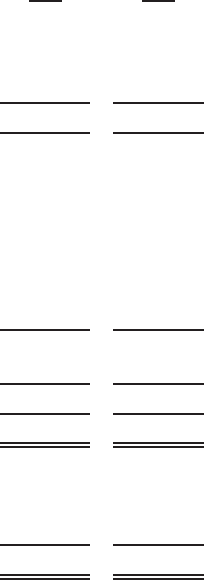

The components of the net deferred income tax liability (asset) at December 31 are as follows:

($ in thousands) 2013 2012

Deferred income tax liabilities:

Property, plant and equipment basis differences ..................... $1,950,720 $1,959,028

Intangibles ........................................................ 885,661 929,749

Other, net ......................................................... 25,954 29,564

$2,862,335 $2,918,341

Deferred income tax assets:

Pension liability . .................................................. 216,890 306,421

Tax operating loss carryforward .................................... 130,733 154,892

Employee benefits ................................................. 161,493 177,464

State tax liability .................................................. (642) 7,422

Accrued expenses.................................................. 26,223 43,162

Allowance for doubtful accounts.................................... 11,957 35,181

Other, net ......................................................... 42,915 14,025

589,569 738,567

Less: Valuation allowance ....................................... (112,671) (78,784)

Net deferred income tax asset ...................................... 476,898 659,783

Net deferred income tax liability . ................................ $2,385,437 $2,258,558

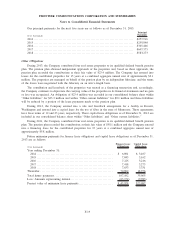

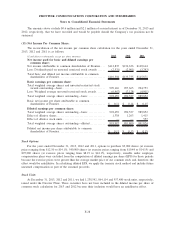

Deferred tax assets and liabilities are reflected in the following

captions on the consolidated balance sheet:

Deferred income taxes ............................................. $2,417,108 $2,357,210

Income taxes and other current assets............................... (31,671) (98,652)

Net deferred income tax liability . ................................ $2,385,437 $2,258,558

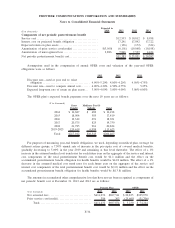

Our state tax operating loss carryforward as of December 31, 2013 is estimated at $2.5 billion. A portion

of our state loss carryforward begins to expire in 2014 through 2032.

F-26

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements