Frontier Communications 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

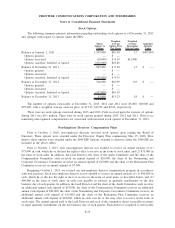

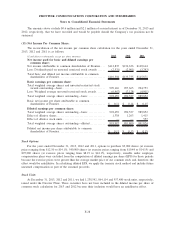

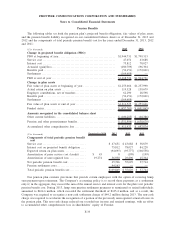

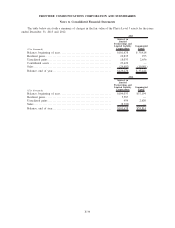

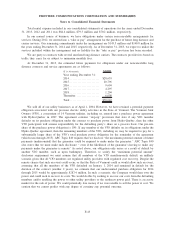

Pension Benefits

The following tables set forth the pension plan’s projected benefit obligations, fair values of plan assets

and the pension benefit liability recognized on our consolidated balance sheets as of December 31, 2013 and

2012 and the components of total periodic pension benefit cost for the years ended December 31, 2013, 2012

and 2011:

($ in thousands) 2013 2012

Change in projected benefit obligation (PBO)

PBO at beginning of year . . . ......................................... $1,944,731 $1,799,313

Service cost ......................................................... 47,651 43,688

Interest cost ......................................................... 75,812 78,027

Actuarial (gain)/loss.................................................. (180,709) 196,304

Benefits paid ........................................................ (54,151) (172,601)

Settlements .......................................................... (164,608) —

PBO at end of year .................................................. $1,668,726 $1,944,731

Change in plan assets

Fair value of plan assets at beginning of year . . ....................... $1,253,666 $1,257,990

Actual return on plan assets . ......................................... 119,328 139,679

Employer contributions, net of transfers ............................... 62,290 28,598

Benefits paid ........................................................ (54,151) (172,601)

Settlements .......................................................... (164,608) —

Fair value of plan assets at end of year ............................... $1,216,525 $1,253,666

Funded status ........................................................ $ (452,201) $ (691,065)

Amounts recognized in the consolidated balance sheet

Other current liabilities ............................................... $ (100,205) $ (60,386)

Pension and other postretirement benefits.............................. $ (351,996) $ (630,679)

Accumulated other comprehensive loss ................................ $ 411,432 $ 697,874

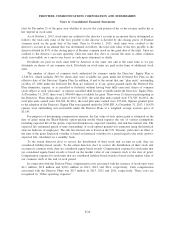

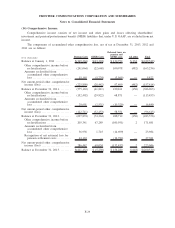

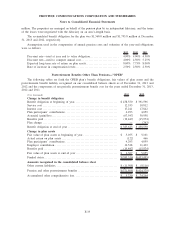

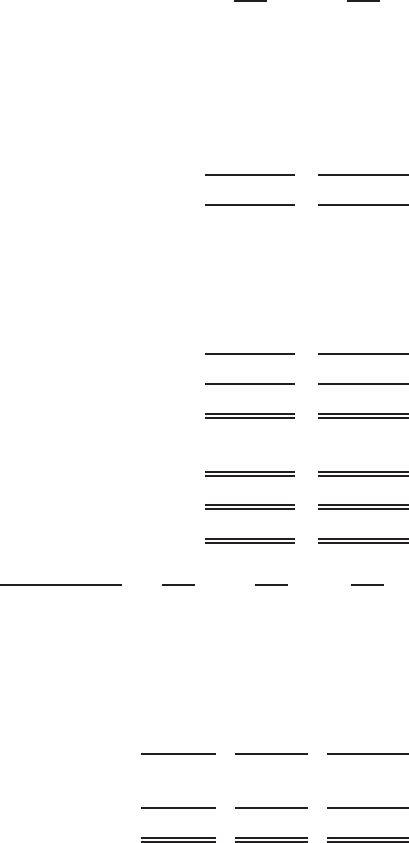

($ in thousands) Expected in 2014 2013 2012 2011

Components of total periodic pension benefit

cost

Service cost .................................. $ 47,651 $ 43,688 $ 38,879

Interest cost on projected benefit obligation .... 75,812 78,027 84,228

Expected return on plan assets ................. (94,695) (95,777) (100,558)

Amortization of prior service cost /(credit) ..... $ 45 8 (199) (199)

Amortization of unrecognized loss ............. 19,274 36,930 29,890 15,364

Net periodic pension benefit cost .............. 65,706 55,629 37,714

Pension settlement costs ....................... 44,163 — —

Total periodic pension benefit cost ............. $109,869 $ 55,629 $ 37,714

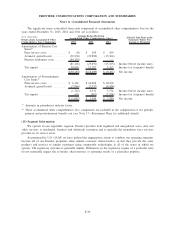

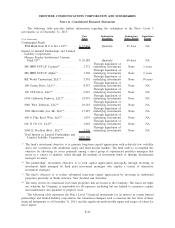

Our pension plan contains provisions that provide certain employees with the option of receiving lump

sum payment upon retirement. The Company’s accounting policy is to record these payments as a settlement

only if, in the aggregate, they exceed the sum of the annual service and interest costs for the plan’s net periodic

pension benefit cost. During 2013, lump sum pension settlement payments to terminated or retired individuals

amounted to $164.6 million, which exceeded the settlement threshold of $125.4 million, and as a result, the

Company was required to recognize a non-cash settlement charge of $44.2 million during 2013. The non-cash

charge was required to accelerate the recognition of a portion of the previously unrecognized actuarial losses in

the pension plan. This non-cash charge reduced our recorded net income and retained earnings, with an offset

to accumulated other comprehensive loss in shareholders’ equity of Frontier.

F-33

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements