Frontier Communications 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

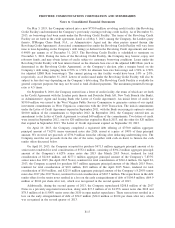

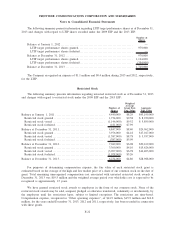

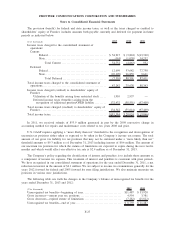

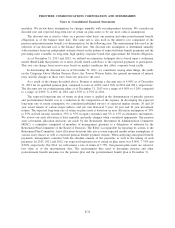

(12) Income Taxes:

The following is a reconciliation of the provision for income taxes computed at federal statutory rates to

the effective rates for the years ended December 31, 2013, 2012 and 2011:

2013 2012 2011

Consolidated tax provision at federal statutory rate . ..................... 35.0% 35.0% 35.0%

State income tax provisions, net of federal income tax benefit ........... (2.7) 2.4 4.0

Noncontrolling interest ................................................. (0.6) (2.5) (1.1)

Tax reserve adjustment ................................................ (1.1) (5.4) (4.0)

Changes in certain deferred tax balances . ............................... (4.0) 3.1 (2.7)

IRS audit adjustments. ................................................. 3.2 — —

Federal research and development credit . ............................... (3.2) — —

Reversal of tax credits ................................................. — — 4.4

Non-deductible transaction costs ........................................ 2.0 — —

All other, net.......................................................... 0.4 0.4 0.3

Effective tax rate ...................................................... 29.0% 33.0% 35.9%

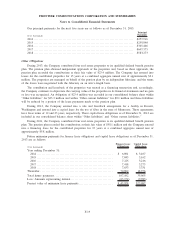

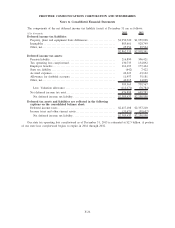

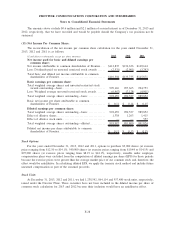

Income taxes for 2013 include the impact of a $6.5 million net benefit resulting from the adjustment of

deferred tax balances, a $5.2 million benefit from federal research and development credits and a $1.8 million

benefit from the net reversal of reserves for uncertain tax positions, partially offset by the impact of a charge of

$5.2 million resulting from the settlement of the 2010 IRS audit, and a charge of $3.3 million resulting from

non-deductible transaction costs.

Income taxes for 2012 and 2011 include the net reversal of reserves for uncertain tax positions for $12.3

million and $9.9 million, respectively. Deferred tax balances were increased in 2012 to reflect changes in

estimates and changes in state effective rates and filing methods.

Income taxes for 2011 include the reduction of deferred tax balances based on the application of enacted

state tax statutes for $6.8 million, partially offset by the impact of a $10.8 million charge resulting from the

enactment on May 25, 2011 of the Michigan Corporate Income Tax that eliminated certain future tax

deductions.

F-25

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements