Frontier Communications 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

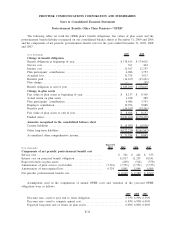

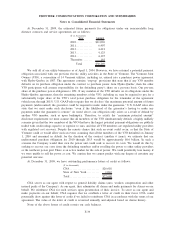

Postretirement Benefits Other Than Pensions—“OPEB”

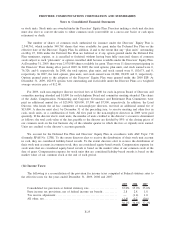

The following tables set forth the OPEB plan’s benefit obligations, fair values of plan assets and the

postretirement benefit liability recognized on our consolidated balance sheets at December 31, 2009 and 2008

and the components of net periodic postretirement benefit costs for the years ended December 31, 2009, 2008

and 2007.

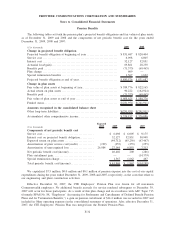

($ in thousands) 2009 2008

Change in benefit obligation

Benefit obligation at beginning of year.................................. $ 178,615 $ 174,602

Service cost ........................................................... 361 444

Interest cost ........................................................... 11,017 11,255

Plan participants’ contributions ......................................... 4,086 3,753

Actuarial loss. . . ....................................................... 11,378 3,917

Benefits paid . . . ....................................................... (16,167) (15,261)

Plan change ........................................................... — (95)

Benefit obligation at end of year . . . .................................... $ 189,290 $ 178,615

Change in plan assets

Fair value of plan assets at beginning of year ........................... $ 8,137 $ 9,369

Actual return on plan assets ............................................ 1,018 388

Plan participants’ contributions ......................................... 4,086 3,753

Employer contribution.................................................. 10,954 9,888

Benefits paid . . . ....................................................... (16,167) (15,261)

Fair value of plan assets at end of year ................................. $ 8,028 $ 8,137

Funded status. . . ....................................................... $(181,262) $(170,478)

Amounts recognized in the consolidated balance sheet

Current liabilities ...................................................... $ (9,052) $ (8,916)

Other long-term liabilities . ............................................. $(172,210) $(161,562)

Accumulated other comprehensive income............................... $ 21,554 $ 8,045

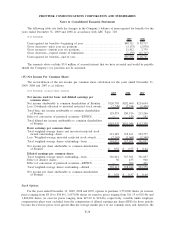

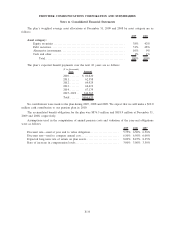

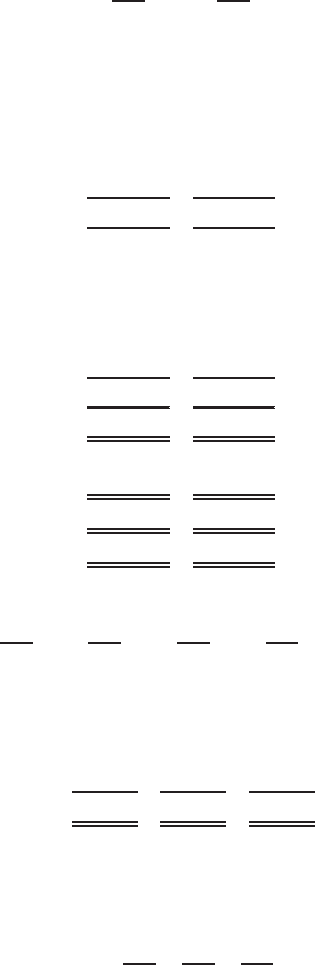

($ in thousands)

Expected

2010 2009 2008 2007

Components of net periodic postretirement benefit cost

Service cost . . . ................................................. $ 361 $ 444 $ 533

Interest cost on projected benefit obligation ...................... 11,017 11,255 10,241

Expected return on plan assets . . . ............................... (439) (514) (578)

Amortization of prior service cost/(credit) . . ...................... (7,716) (7,751) (7,751) (7,735)

Amortization of unrecognized loss ............................... 6,324 5,041 5,946 6,099

Net periodic postretirement benefit cost .......................... $ 8,229 $ 9,380 $ 8,560

Assumptions used in the computation of annual OPEB costs and valuation of the year-end OPEB

obligations were as follows:

2009 2008 2007

Discount rate—used at year end to value obligation . ........................ 5.75% 6.50% 6.50%

Discount rate—used to compute annual cost................................. 6.50% 6.50% 6.00%

Expected long-term rate of return on plan assets ............................ 6.00% 6.00% 6.00%

F-34

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements