Frontier Communications 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

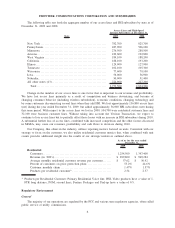

Employees

As of December 31, 2009, we had approximately 5,400 employees. Approximately 2,800 of our employees

are affiliated with a union. The number of union employees covered by agreements expiring during 2010 is

approximately 750. We consider our relations with our employees to be good.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934. Accordingly, we

file periodic reports, proxy statements and other information with the Securities and Exchange Commission

(SEC). Such reports, proxy statements and other information may be obtained by visiting the Public Reference

Room of the SEC at 100 F Street, NE, Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In

addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information

statements and other information regarding the Company and other issuers that file electronically. Material filed

by us can also be inspected at the offices of the New York Stock Exchange, Inc. (NYSE), 20 Broad Street, New

York, NY 10005, on which our common stock is listed.

We make available, free of charge on our website, our Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to

Section 13(a) or 15(d) of the Exchange Act, as soon as practicable after we electronically file these documents

with, or furnish them to, the SEC. These documents may be accessed through our website at www.frontier.com

under “Investor Relations.” The information posted or linked on our website is not part of this report.

We also make available on our website, or in printed form upon request, free of charge, our Corporate

Governance Guidelines, Code of Business Conduct and Ethics, and the charters for the Audit, Compensation,

and Nominating and Corporate Governance committees of the Board of Directors. Stockholders may request

printed copies of these materials by writing to: 3 High Ridge Park, Stamford, Connecticut 06905 Attention:

Corporate Secretary. Our website address is www.frontier.com.

Item 1A. Risk Factors

Before you make an investment decision with respect to any of our securities, you should carefully

consider all the information we have included or incorporated by reference in this Form 10-K and our

subsequent periodic filings with the SEC. In particular, you should carefully consider the risk factors described

below and read the risks and uncertainties related to “forward-looking statements” as set forth in the

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this

Form 10-K. The risks and uncertainties described below are not the only ones facing our company. Additional

risks and uncertainties that are not presently known to us or that we currently deem immaterial or that are not

specific to us, such as general economic conditions, may also adversely affect our business and operations. The

following risk factors should be read in conjunction with MD&A and the consolidated financial statements and

related notes included in this report.

Risks Related to the Verizon Transaction

References to “the Company” in this section refer to Frontier as the combined company following the

closing of the Verizon Transaction, assuming the Verizon Transaction closes.

The Verizon Transaction may not be consummated on the terms or timeline currently contemplated or

at all.

The consummation of the Verizon Transaction is subject to certain conditions, including (i) the availability

of financing on terms that satisfy certain requirements (including with respect to pricing and maturity) and the

receipt of the proceeds thereof that, taken together with any Spinco debt securities and the aggregate amount of

Spinco indebtedness at the distribution date, equal $3.333 billion, (ii) the absence of a governmental order that

would constitute a materially adverse regulatory condition, (iii) the receipt of applicable regulatory consents,

(iv) the receipt of certain favorable tax rulings from the Internal Revenue Service (which have been obtained)

and certain tax opinions, (v) the absence of a material adverse effect on Frontier or on Spinco or the Spinco

business and (vi) other customary closing conditions. We can make no assurances that the Verizon Transaction

11

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES