Frontier Communications 2009 Annual Report Download - page 24

Download and view the complete annual report

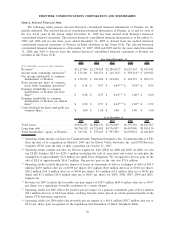

Please find page 24 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Federal subsidies representing interstate access support, rural high cost loop support and local switching

support represented approximately $69.1 million, or 3%, of Frontier’s revenues in 2009. Frontier currently

expects that as a result of both an increase in the national average cost per loop and a decrease in Frontier’s and

the Spinco business’s cost structure, there will be a decrease in the subsidy revenues Frontier and the Spinco

business will earn in 2010 through the Federal High Cost Loop Fund. The amount of federal interstate access

support funds received may also decline as that fund is also subject to a national cap and the amounts allocated

among carriers within that cap can vary from year to year. State subsidies represented approximately $8.7

million, or less than 1%, of Frontier’s revenues in 2009. Approximately $35.5 million, or 2%, of Frontier’s

2009 revenues, represents a surcharge to customers (local, long distance and interconnection) to recover

universal service fund contribution fees which are remitted to the FCC and recorded as an expense in “other

operating expenses.” Frontier expects that approximately 5% of the Company’s revenue will continue to be

derived from federal and state subsidies, and from surcharges to customers.

The Company and its industry will likely remain highly regulated, and the Company will likely incur

substantial compliance costs that could constrain its ability to compete in its target markets.

As an incumbent local exchange carrier, the Company will be subject to significant regulation from

federal, state and local authorities. This regulation will restrict the Company’s ability to change its rates,

especially on its basic services and its access rates, and will impose substantial compliance costs on the

Company. Regulation will constrain the Company’s ability to compete and, in some jurisdictions, it may

restrict how the Company is able to expand its service offerings. In addition, changes to the regulations that

govern the Company may have an adverse effect upon its business by reducing the allowable fees that it may

charge, imposing additional compliance costs or otherwise changing the nature of its operations and the

competition in its industry.

Pending FCC rulemakings and state regulatory proceedings, including those relating to intercarrier

compensation and universal service, could have a substantial adverse impact on the Company’s operations.

Risks Related to Technology

The risks discussed below in this section refer to the “Company” for ease of reference. The risks apply to

Frontier as a stand-alone entity before the Verizon Transaction is completed and will continue to apply to

Frontier if the Verizon Transaction is not completed for any reason and will also apply to the combined

company assuming the Verizon Transaction closes.

In the future, as competition intensifies within the Company’s markets, the Company may be unable to

meet the technological needs or expectations of its customers, and may lose customers as a result.

The communications industry is subject to significant changes in technology. If the Company does not

replace or upgrade technology and equipment, it may be unable to compete effectively because it will not be

able to meet the needs or expectations of its customers. Replacing or upgrading the combined infrastructure

could result in significant capital expenditures.

In addition, rapidly changing technology in the communications industry may influence the Company’s

customers to consider other service providers. For example, the Company may be unable to retain customers

who decide to replace their wireline telephone service with wireless telephone service. In addition, VoIP

technology, which operates on broadband technology, now provides the Company’s competitors with a

competitive alternative to provide voice services to the Company’s customers, and wireless broadband

technologies may permit the Company’s competitors to offer broadband data services to the Company’s

customers throughout most or all of its service areas.

Item 1B. Unresolved Staff Comments

None.

22

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES