Frontier Communications 2009 Annual Report Download - page 75

Download and view the complete annual report

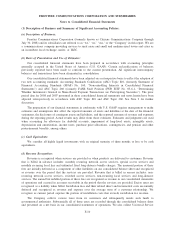

Please find page 75 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(ASC Topic 805), such costs are required to be expensed as incurred and are reflected in “Acquisition and

integration costs” in our consolidated statements of operations.

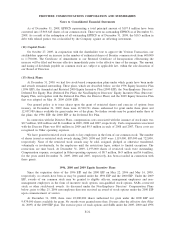

Noncontrolling Interests in Consolidated Financial Statements

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements” (currently ASC Topic 810). SFAS No. 160 (ASC Topic 810) establishes requirements for

ownership interest in subsidiaries held by parties other than the Company (sometimes called “minority

interest”) be clearly identified, presented and disclosed in the consolidated statement of financial position

within equity, but separate from the parent’s equity. All changes in the parent’s ownership interest are required

to be accounted for consistently as equity transactions and any noncontrolling equity investments in

unconsolidated subsidiaries must be measured initially at fair value. SFAS No. 160 (ASC Topic 810) was

effective, on a prospective basis, for fiscal years beginning after December 15, 2008. However, presentation

and disclosure requirements must be retrospectively applied to comparative financial statements. The adoption

of SFAS No. 160 (ASC Topic 810) in the first quarter of 2009 did not have a material impact on our financial

position, results of operations or cash flows.

Determining Whether Instruments Granted in Share-Based Payment Transactions are Participating

Securities

In June 2008, the FASB ratified FSP EITF No. 03-6-1, “Determining Whether Instruments Granted in

Share-Based Payment Transactions are Participating Securities” (currently ASC Topic 260). FSP EITF No. 03-

6-1 (ASC Topic 260) addresses whether instruments granted in share-based payment transactions are

participating securities prior to vesting and, therefore, should be included in the earnings allocation in

computing earnings per share under the two-class method. FSP EITF No. 03-6-1 (ASC Topic 260) was

effective, on a retrospective basis, for financial statements issued for fiscal years beginning after December 15,

2008, and interim periods within those years. Our outstanding non-vested restricted stock is a participating

security in accordance with FSP EITF No. 03-6-1 (ASC Topic 260) and we have adjusted our previously

reported basic and diluted income per common share. The adoption of FSP EITF No. 03-6-1 (ASC Topic 260)

in the first quarter of 2009 did not have a material impact on our basic and diluted income per common share.

Employers’ Disclosures about Postretirement Benefit Plan Assets

In December 2008, the FASB issued FSP SFAS No. 132 (R)-1, “Employers’ Disclosures about

Postretirement Benefit Plan Assets” (currently ASC Topic 715). FSP SFAS No. 132(R)-1 (ASC Topic 715)

amends SFAS No. 132, “Employers’ Disclosures about Pensions and Other Postretirement Benefits,” (ASC

Topic 230) to provide guidance on an employers’ disclosures about plan assets of a defined benefit pension or

other postretirement plan. FSP SFAS No. 132(R)-1 (ASC Topic 715) requires additional disclosures about

investment policies and strategies, categories of plan assets, fair value measurements of plan assets and

significant concentrations of risk. The disclosures about plan assets required by FSP SFAS No. 132(R)-1 (ASC

Topic 715) are effective for fiscal years ending after December 15, 2009. The adoption of the disclosure

requirements of FSP SFAS No. 132(R)-1 (ASC Topic 715) in 2009 did not have a material impact on our

financial position, results of operations or cash flows.

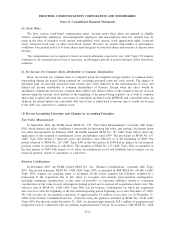

Subsequent Events

In May 2009, the FASB issued SFAS No. 165, “Subsequent Events” (currently ASC Topic 855), which

establishes general standards of accounting for and disclosure of events that occur after the balance sheet date

but before financial statements are issued or are available to be issued. In particular, SFAS No. 165 (ASC

Topic 855) sets forth the period after the balance sheet date during which management of a reporting entity

should evaluate events or transactions that may occur for potential recognition or disclosure in the financial

statements, the circumstances under which an entity should recognize events or transactions occurring after the

balance sheet date in its financial statements, and the disclosures that an entity should make about events or

F-13

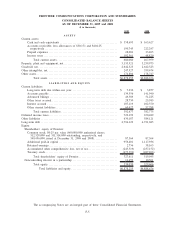

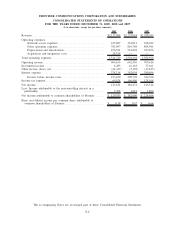

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements