Frontier Communications 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

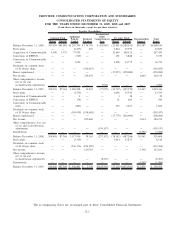

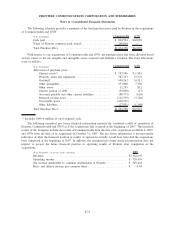

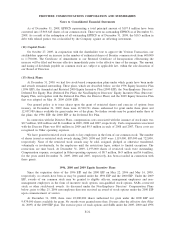

The following schedule provides a summary of the final purchase price paid by Frontier in the acquisitions

of Commonwealth and GVN:

($ in thousands) Commonwealth GVN

Cash paid ................................................... $ 804,554 $62,001

Value of Frontier common stock issued....................... 249,804 —

Total Purchase Price ......................................... $1,054,358 $62,001

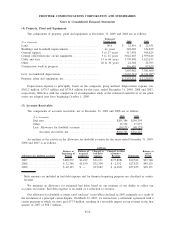

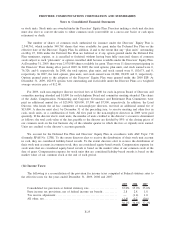

With respect to our acquisitions of Commonwealth and GVN, the purchase price has been allocated based

on fair values to the net tangible and intangible assets acquired and liabilities assumed. The final allocations

were as follows:

($ in thousands) Commonwealth GVN

Allocation of purchase price:

Current assets(1) ......................................... $ 187,986 $ 1,581

Property, plant and equipment . . . ........................ 387,343 23,578

Goodwill ............................................... 690,262 34,311

Other intangibles........................................ 273,800 7,250

Other assets . ........................................... 11,285 812

Current portion of debt. ................................. (35,000) (17)

Accounts payable and other current liabilities............. (80,375) (626)

Deferred income taxes. . ................................. (143,539) (3,740)

Convertible notes ....................................... (209,553) —

Other liabilities ......................................... (27,851) (1,148)

Total Purchase Price ......................................... $1,054,358 $62,001

(1) Includes $140.6 million of total acquired cash.

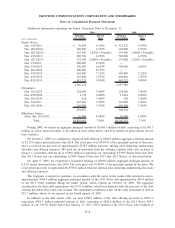

The following unaudited pro forma financial information presents the combined results of operations of

Frontier, Commonwealth and GVN as if the acquisitions had occurred at the beginning of 2007. The historical

results of the Company include the results of Commonwealth from the date of its acquisition on March 8, 2007,

and GVN from the date of its acquisition on October 31, 2007. The pro forma information is not necessarily

indicative of what the financial position or results of operations actually would have been had the acquisitions

been completed at the beginning of 2007. In addition, the unaudited pro forma financial information does not

purport to project the future financial position or operating results of Frontier after completion of the

acquisitions.

($ in thousands, except per share amounts) 2007

Revenue. . . .............................................................. $2,362,695

Operating income . . . ..................................................... $ 720,476

Net income attributable to common shareholders of Frontier ............... $ 218,428

Basic and diluted income per common share .............................. $ 0.65

F-15

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements