Frontier Communications 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.synergies or that these benefits will be realized within the expected time frames. In addition, acquired

businesses may have unanticipated liabilities or contingencies.

If the Company completes an acquisition, investment or other strategic transaction, the Company may

require additional financing that could result in an increase in the number of its outstanding shares or the

aggregate amount of its debt, although there are restrictions on the ability of the Company to issue additional

shares of stock for these purposes for two years after the merger. See Risks Relating to the Verizon

Transaction—“Frontier will be unable to take certain actions after the merger because such actions could

jeopardize the tax-free status of the spin-off or the merger, and such restrictions could be significant.” The

number of shares of the Company’s common stock or the aggregate principal amount of its debt that it may

issue may be significant. A strategic transaction may result in a change in control of the Company or otherwise

materially and adversely affect its business.

A significant portion of the Company’s work force is retirement eligible.

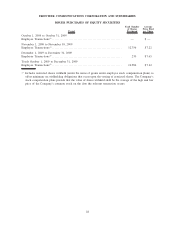

As of December 31, 2009, approximately 1,200, or 22%, of Frontier’s approximately 5,400 active

employees are retirement eligible. It is expected that a significant number of the Spinco employees are or will

be retirement eligible at or prior to the time of closing of the Verizon Transaction. If these employees were to

retire and could not be promptly replaced, customer service could be negatively impacted, which could have a

material impact on the Company’s operations and financial results.

If the Company is unable to hire or retain key personnel, it may be unable to successfully operate its

business.

The Company’s success will depend in part upon the continued services of its management. The Company

cannot guarantee that these key personnel and others will not leave or compete with it. The loss, incapacity or

unavailability for any reason of key members of the management team could have a material impact on the

Company’s business. In addition, the Company’s financial results and its ability to compete will suffer should it

become unable to attract, integrate or retain other qualified personnel in the future.

Risks Related to Liquidity, Financial Resources and Capitalization

The risks discussed below in this section refer to the “Company” for ease of reference. The risks apply to

Frontier as a stand-alone entity before the Verizon Transaction is completed and will continue to apply to

Frontier if the Verizon Transaction is not completed for any reason and will also apply to the combined

company assuming the Verizon Transaction closes.

If the lingering impact of the severe contraction in the global financial markets and current economic

conditions continue through 2010, this economic scenario may have an impact on the Company’s business

and financial condition.

The diminished availability of credit and liquidity due to the lingering impact of the severe contraction in

the global financial markets and current economic conditions may continue through 2010. This economic

scenario may affect the financial health of the Company’s customers, vendors and partners, which in turn may

negatively affect the Company’s revenues, operating expenses and cash flows. In addition, although Frontier

believes, based on currently available information, that the financial institutions that have outstanding

commitments under Frontier’s revolving credit facility will be able to fulfill their commitments to the

Company, if the current economic environment and the recent severe contraction in the global financial markets

continue through 2010 or beyond, this could change in the future. It is Frontier’s intention to replace its existing

$250.0 million revolving credit facility with a significantly larger facility by the closing date of the Verizon

Transaction.

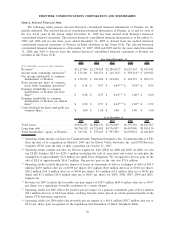

Volatility in asset values related to Frontier’s pension plan and our assumption of Spinco’s pension

plan obligations may require us to make cash contributions to fund pension plan liabilities.

As a result of the ongoing payment of benefits and negative investment returns arising from a contraction

in the global financial markets, Frontier’s pension plan assets have declined from $822.2 million at December

31, 2007, to $608.6 million at December 31, 2009, a decrease of $213.6 million, or 26%. This decrease

consisted of a decline in asset value of $72.8 million, or 9%, and benefits paid of $140.8 million, or 17%. As a

19

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES