Frontier Communications 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

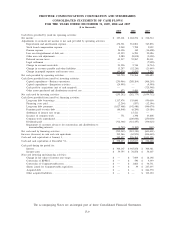

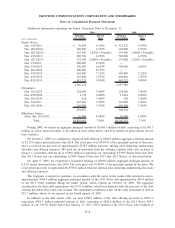

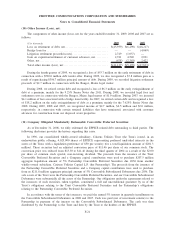

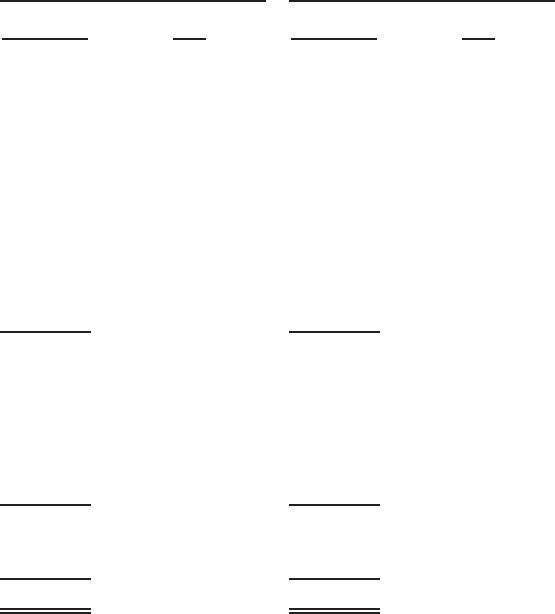

Additional information regarding our Senior Unsecured Debt at December 31:

($ in thousands)

Principal

Outstanding

Interest

Rate

Principal

Outstanding

Interest

Rate

2009 2008

Senior Notes:

Due 5/15/2011. . .................... $ 76,089 9.250% $ 921,276 9.250%

Due 10/24/2011 .................... 200,000 6.270% 200,000 6.270%

Due 12/31/2012 .................... 145,500 1.625% (Variable) 147,000 2.448% (Variable)

Due 1/15/2013. . .................... 580,724 6.250% 700,000 6.250%

Due 12/31/2013 .................... 132,638 2.000% (Variable) 133,988 2.250% (Variable)

Due 5/1/2014. . . .................... 600,000 8.250% —

Due 3/15/2015. . .................... 300,000 6.625% 300,000 6.625%

Due 10/1/2018. . .................... 600,000 8.125% —

Due 3/15/2019. . .................... 434,000 7.125% 450,000 7.125%

Due 1/15/2027. . .................... 345,858 7.875% 400,000 7.875%

Due 8/15/2031. . .................... 945,325 9.000% 945,325 9.000%

4,360,134 4,197,589

Debentures:

Due 11/1/2025. . .................... 138,000 7.000% 138,000 7.000%

Due 8/15/2026. . .................... 1,739 6.800% 11,614 6.800%

Due 10/1/2034. . .................... 628 7.680% 628 7.680%

Due 7/1/2035. . . .................... 125,000 7.450% 125,000 7.450%

Due 10/1/2046. . .................... 193,500 7.050% 193,500 7.050%

458,867 468,742

Subsidiary Senior

Notes due 12/1/2012 ................ 36,000 8.050% 36,000 8.050%

Total ........................ $4,855,001 7.86% $4,702,331 7.54%

During 2009, we retired an aggregate principal amount of $1,048.3 million of debt, consisting of $1,047.3

million of senior unsecured debt, as described in more detail below, and $1.0 million of rural utilities service

loan contracts.

On October 1, 2009, we completed a registered debt offering of $600.0 million aggregate principal amount

of 8.125% senior unsecured notes due 2018. The issue price was 98.441% of the principal amount of the notes,

and we received net proceeds of approximately $578.7 million from the offering after deducting underwriting

discounts and offering expenses. We used the net proceeds from the offering, together with cash on hand, to

finance a cash tender offer for up to $700.0 million to purchase our outstanding 9.250% Senior Notes due 2011

(the 2011 Notes) and our outstanding 6.250% Senior Notes due 2013 (the 2013 Notes), as described below.

On April 9, 2009, we completed a registered offering of $600.0 million aggregate principal amount of

8.25% senior unsecured notes due 2014. The issue price was 91.805% of the principal amount of the notes. We

received net proceeds of approximately $538.8 million from the offering after deducting underwriting discounts

and offering expenses.

The Company accepted for purchase, in accordance with the terms of the tender offer referred to above,

approximately $564.4 million aggregate principal amount of the 2011 Notes and approximately $83.4 million

of the 2013 Notes tendered during the tender period, which expired on October 16, 2009. The aggregate

consideration for these debt repurchases was $701.6 million, which was financed with the proceeds of the debt

offering described above and cash on hand. The repurchases resulted in a loss on the early retirement of debt of

$53.7 million, which we recognized in the fourth quarter of 2009.

In addition to the debt tender offer, we used $388.9 million of the debt offering proceeds in 2009 to

repurchase $396.7 million principal amount of debt, consisting of $280.8 million of the 2011 Notes, $54.1

million of our 7.875% Senior Notes due January 15, 2027, $35.9 million of the 2013 Notes, $16.0 million of

F-18

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements