Frontier Communications 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

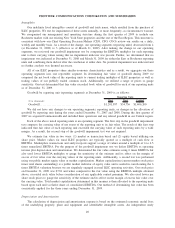

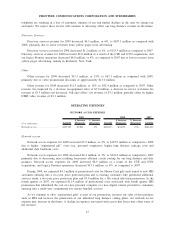

ACQUISITION AND INTEGRATION COSTS

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2009 2008 2007

Acquisition and integration costs. . . . . . . . $28,334 $28,334 100% $— $— — $—

Acquisition and integration costs represent expenses incurred to close the transaction (legal, financial

advisory, accounting, regulatory and other related costs) and integrate the network and information technology

platforms. While the Company continues to evaluate certain other expenses, we currently expect to incur

acquisition and integration costs of approximately $100.0 million in 2010. We anticipate closing the Verizon

Transaction during the second quarter of 2010.

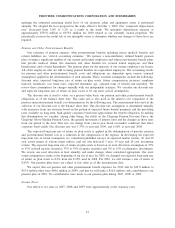

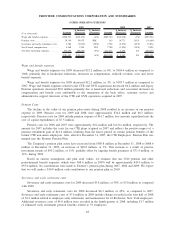

INVESTMENT INCOME/OTHER INCOME (LOSS), NET / INTEREST EXPENSE /

INCOME TAX EXPENSE

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2009 2008 2007

Investment income ................... $ 6,285 $ (9,833) (61%) $ 16,118 $(21,523) (57%) $ 37,641

Other income (loss), net . . . . . . . . . . . . . . $ (41,127) $(35,957) NM $ (5,170) $ 12,663 71% $ (17,833)

Interest expense . . . ................... $378,214 $ 15,580 4% $362,634 $(18,062) (5%) $380,696

Income tax expense . . . . . . . . . . . . . . . . . . $ 69,928 $(36,568) (34%) $106,496 $(21,518) (17%) $128,014

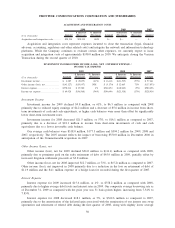

Investment Income

Investment income for 2009 declined $9.8 million, or 61%, to $6.3 million as compared with 2008

primarily due to reduced equity earnings of $4.2 million and a decrease of $5.6 million in income from short-

term investments of cash and cash equivalents, as higher cash balances were more than offset by significantly

lower short-term investment rates.

Investment income for 2008 decreased $21.5 million, or 57%, to $16.1 million as compared to 2007,

primarily due to a decrease of $22.1 million in income from short-term investments of cash and cash

equivalents due to a lower investable cash balance.

Our average cash balances were $318.0 million, $177.5 million and $594.2 million for 2009, 2008 and

2007, respectively. The 2007 amount reflects the impact of borrowing $550.0 million in December 2006 in

anticipation of the Commonwealth acquisition in 2007.

Other Income (Loss), net

Other income (loss), net for 2009 declined $36.0 million to $(41.1) million as compared with 2008,

primarily due to premiums paid on the early retirement of debt of $45.9 million in 2009, partially offset by

increased litigation settlement proceeds of $3.8 million.

Other income (loss), net for 2008 improved $12.7 million, or 71%, to $(5.2) million as compared to 2007.

Other income (loss), net improved in 2008 primarily due to a reduction in the loss on retirement of debt of

$11.9 million and the $4.1 million expense of a bridge loan fee recorded during the first quarter of 2007.

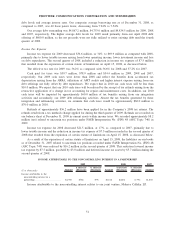

Interest Expense

Interest expense for 2009 increased $15.6 million, or 4%, to $378.2 million as compared with 2008,

primarily due to higher average debt levels and interest rates in 2009. Our composite average borrowing rate as

of December 31, 2009 as compared with the prior year was 31 basis points higher, increasing from 7.54% to

7.85%.

Interest expense for 2008 decreased $18.1 million, or 5%, to $362.6 million as compared to 2007,

primarily due to the amortization of the deferred gain associated with the termination of our interest rate swap

agreements and retirement of related debt during the first quarter of 2008, along with slightly lower average

50

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES