Frontier Communications 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

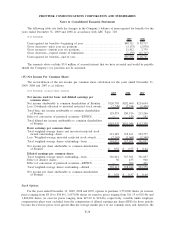

effect would be antidilutive. In calculating diluted EPS we apply the treasury stock method and include future

unearned compensation as part of the assumed proceeds.

In addition, for the years ended December 31, 2009, 2008 and 2007, the impact of dividends paid on

unvested restricted stock awards have been deducted from net income attributable to common shareholders of

Frontier in accordance with FSP EITF No. 03-6-1 (ASC Topic 260), which we adopted in the first quarter of

2009 on a retrospective basis.

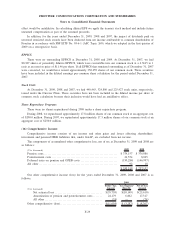

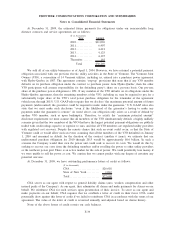

EPPICS

There were no outstanding EPPICS at December 31, 2008 and 2009. At December 31, 2007, we had

80,307 shares of potentially dilutive EPPICS, which were convertible into our common stock at a 4.3615 to 1

ratio at an exercise price of $11.46 per share. If all EPPICS that remained outstanding as of December 31, 2007

were converted, we would have issued approximately 350,259 shares of our common stock. These securities

have been included in the diluted earnings per common share calculation for the period ended December 31,

2007.

Stock Units

At December 31, 2009, 2008 and 2007, we had 440,463, 324,806 and 225,427 stock units, respectively,

issued under the Director Plans. These securities have not been included in the diluted income per share of

common stock calculation because their inclusion would have had an antidilutive effect.

Share Repurchase Programs

There were no shares repurchased during 2009 under a share repurchase program.

During 2008, we repurchased approximately 17.8 million shares of our common stock at an aggregate cost

of $200.0 million. During 2007, we repurchased approximately 17.3 million shares of our common stock at an

aggregate cost of $250.0 million.

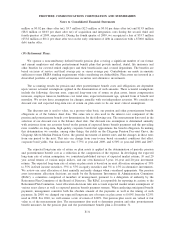

(16) Comprehensive Income:

Comprehensive income consists of net income and other gains and losses affecting shareholders’

investment and pension/OPEB liabilities that, under GAAP, are excluded from net income.

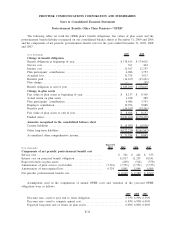

The components of accumulated other comprehensive loss, net of tax at December 31, 2009 and 2008 are

as follows:

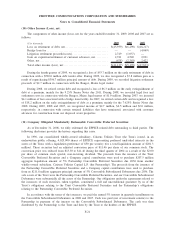

($ in thousands) 2009 2008

Pension costs . . . ....................................................... $ 374,157 $ 376,086

Postretirement costs .................................................... 21,554 8,045

Deferred taxes on pension and OPEB costs . . ........................... (150,284) (146,997)

All other .............................................................. 92 18

$ 245,519 $ 237,152

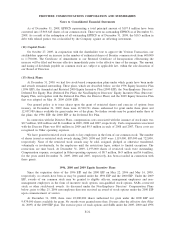

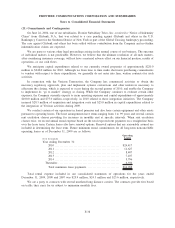

Our other comprehensive income (loss) for the years ended December 31, 2009, 2008 and 2007 is as

follows:

($ in thousands)

Before-Tax

Amount

Tax Expense/

(Benefit)

Net-of-Tax

Amount

2009

Net actuarial loss ..................................... $(35,759) $(10,149) $(25,610)

Amortization of pension and postretirement costs ....... 24,179 6,862 17,317

All other ............................................. (74) — (74)

Other comprehensive (loss). . ............................... $(11,654) $ (3,287) $ (8,367)

F-29

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements