Frontier Communications 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approvals in the Spinco territory that are required to complete the merger and the spin-off, Frontier

stockholders will collectively own between approximately 29% and 34% of the Company’s outstanding equity

immediately following the closing of the merger. Consequently, Frontier stockholder votes, collectively, will

have significantly less influence over the policies of the Company than they would be able to exercise over the

policies of Frontier immediately prior to the merger. Moreover, the number of shares of Frontier common stock

to be issued to Verizon stockholders pursuant to the merger agreement is subject to increase by any amounts

paid, payable or forgone by Verizon pursuant to orders or settlements that are issued or entered into in order to

obtain government approvals in the Spinco territory that are required to complete the merger or the spin-off,

and any such increase may be significant. In addition, Verizon intends to exercise its right to designate three of

the twelve members of the board of directors of the Company.

The pendency of the merger could adversely affect the business and operations of Frontier and the

Spinco business.

In connection with the pending merger, some customers of each of Frontier and the Spinco business may

delay or defer decisions or may end their relationships with the relevant company, which could negatively

affect the revenues, earnings and cash flows of Frontier and the Spinco business, regardless of whether the

merger is completed. Similarly, current and prospective employees of Frontier and the Spinco business may

experience uncertainty about their future roles with the Company following the merger, which may materially

adversely affect the ability of each of Frontier and the Spinco business to attract and retain key personnel

during the pendency of the merger.

Risks Related to Frontier and the Company’s Business Following the Merger

The risks discussed below in this section refer to the “Company” for ease of reference. The risks apply to

Frontier as a stand-alone entity before the Verizon Transaction is completed, will continue to apply to Frontier

if the Verizon Transaction is not completed for any reason and will also apply to the combined company

assuming the Verizon Transaction closes.

The Company will likely face further reductions in access lines, switched access minutes of use, long

distance revenues and federal and state subsidy revenues, which could adversely affect it.

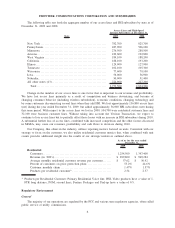

The businesses that will make up the Company have experienced declining access lines, switched access

minutes of use, long distance revenues, federal and state subsidies and related revenues because of economic

conditions, increasing competition, changing consumer behavior (such as wireless displacement of wireline use,

e-mail use, instant messaging and increasing use of VOIP), technology changes and regulatory constraint. For

example, Frontier’s access lines declined 6% in 2009 and 7% in 2008. In addition, Frontier’s switched access

minutes of use declined 12% in 2009 and 9% in 2008 (after excluding the switched access minutes added

through acquisitions in 2007). The Spinco business’s access lines declined 11.6% in 2009 and 10% in 2008. In

addition, the Spinco business’s switched access minutes of use declined 10% in 2009 and 11% in 2008. These

factors, among others, are likely to cause the Company’s local network service, switched network access, long

distance and subsidy revenues to continue to decline, and these factors may cause the Company’s cash

generated by operations to decrease.

The Company will face intense competition, which could adversely affect it.

The communications industry is extremely competitive and competition is increasing. The traditional

dividing lines between local, long distance, wireless, cable and Internet service providers are becoming

increasingly blurred. Through mergers and various service expansion strategies, service providers are striving to

provide integrated solutions both within and across geographic markets. The Company’s competitors will

include competitive local exchange carriers and other providers of services, such as Internet service providers,

wireless companies, VOIP providers and cable companies that may provide services competitive with the

services that the Company will offer or will intend to introduce. Competition will continue to be intense

following the merger, and Frontier cannot assure you that the Company will be able to compete effectively.

Frontier also believes that wireless and cable telephony providers have increased their penetration of various

services in Frontier’s and Spinco’s markets. Frontier expects the Company to continue to lose access lines and

that competition with respect to all the products and services of the Company will increase.

16

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES