Frontier Communications 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

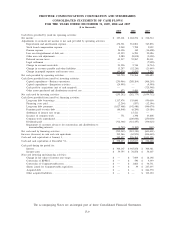

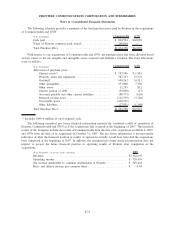

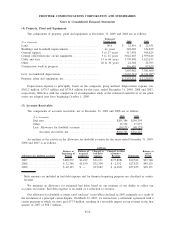

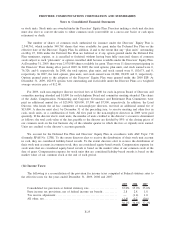

(4) Property, Plant and Equipment:

The components of property, plant and equipment at December 31, 2009 and 2008 are as follows:

($ in thousands)

Estimated

Useful Lives 2009 2008

Land . . . .................................................... N/A $ 22,416 $ 22,631

Buildings and leasehold improvements ....................... 41 years 348,002 344,839

General support . . ........................................... 5 to 17 years 517,958 508,825

Central office/electronic circuit equipment .................... 5 to 11 years 3,042,665 2,959,440

Cable and wire . . ........................................... 15 to 60 years 3,730,998 3,623,193

Other. . . .................................................... 20 to 30 years 24,368 24,703

Construction work in progress ............................... 116,655 97,429

7,803,062 7,581,060

Less: Accumulated depreciation.............................. (4,669,541) (4,341,087)

Property, plant and equipment, net . . . ........................ $ 3,133,521 $ 3,239,973

Depreciation expense is principally based on the composite group method. Depreciation expense was

$362.2 million, $379.5 million and $374.4 million for the years ended December 31, 2009, 2008 and 2007,

respectively. Effective with the completion of an independent study of the estimated useful lives of our plant

assets we adopted new lives beginning October 1, 2009.

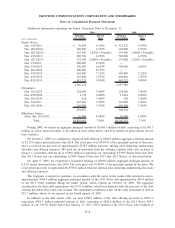

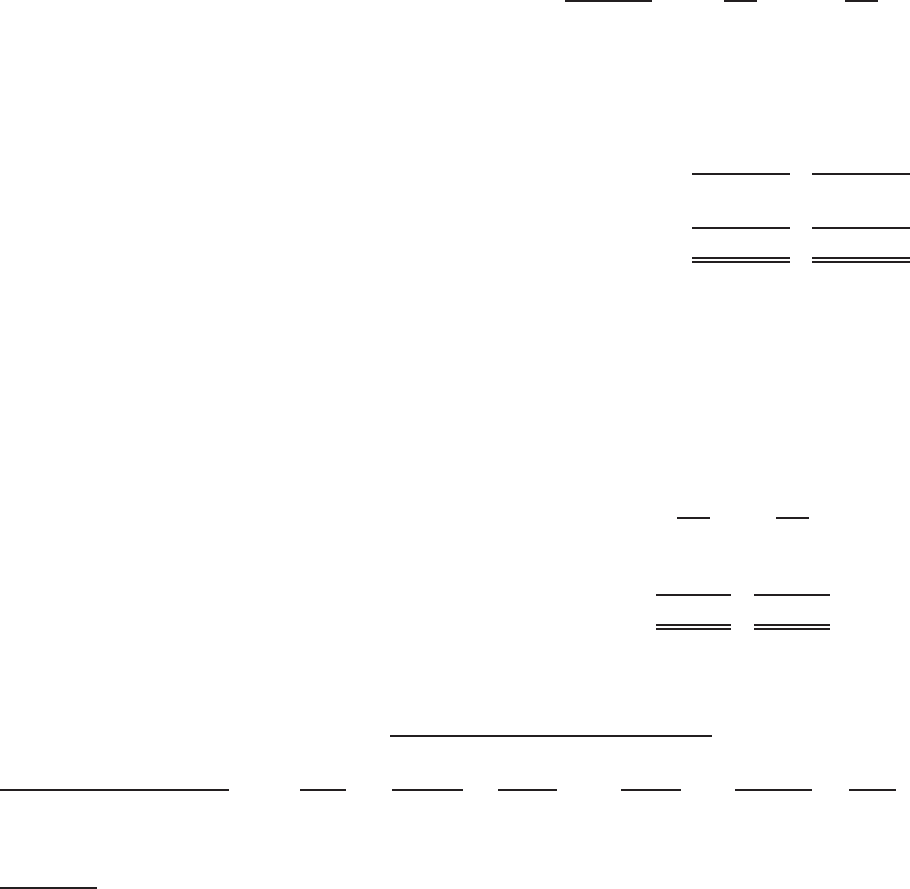

(5) Accounts Receivable:

The components of accounts receivable, net at December 31, 2009 and 2008 are as follows:

($ in thousands) 2009 2008

End user. . . .................................................... $205,384 $244,395

Other .......................................................... 15,532 17,977

Less: Allowance for doubtful accounts . . ........................ (30,171) (40,125)

Accounts receivable, net . .................................. $190,745 $222,247

An analysis of the activity in the allowance for doubtful accounts for the years ended December 31, 2009,

2008 and 2007 is as follows:

Allowance for doubtful accounts

Balance at

beginning of

Period

Balance of

acquired

properties

Charged to

bad debt

expense*

Charged to other

accounts—

Revenue Deductions

Balance at

end of

Period

Additions

2007. . . ...................... $108,537 $1,499 $31,131 $(77,898) $30,521 $32,748

2008. . . ...................... $ 32,748 $1,150 $31,700 $ 2,352 $27,825 $40,125

2009. . . ...................... $ 40,125 $ — $33,682 $ (6,181) $37,455 $30,171

*Such amounts are included in bad debt expense and for financial reporting purposes are classified as contra-

revenue.

We maintain an allowance for estimated bad debts based on our estimate of our ability to collect our

accounts receivable. Bad debt expense is recorded as a reduction to revenue.

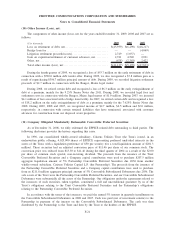

Our allowance for doubtful accounts (and “end user” receivables) declined in 2007, primarily as a result of

the resolution of a principal carrier dispute. On March 12, 2007, we entered into a settlement agreement with a

carrier pursuant to which we were paid $37.5 million, resulting in a favorable impact on our revenue in the first

quarter of 2007 of $38.7 million.

F-16

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements