Frontier Communications 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. Business

Frontier Communications Corporation (Frontier) (formerly known as Citizens Communications Company

through July 30, 2008) and its subsidiaries are referred to as the “Company,” “we,” “us” or “our” throughout

this report and references to the “combined company” refer to the Company following the completion of the

Verizon Transaction (as defined below). Frontier was incorporated in the State of Delaware in 1935 as Citizens

Utilities Company.

Our mission is to be the leader in providing communications services to residential and business customers

in our markets. We are committed to delivering innovative and reliable products and solutions with an

emphasis on convenience, service and customer satisfaction. We offer a variety of voice, data, internet, and

television services that are available as bundled or packaged solutions and for some products, a

´la carte. We

believe that our local management structure, superior customer service and innovative product positioning will

continue to differentiate us from our competitors in the markets in which we compete.

We are a communications company providing services to rural areas and small and medium-sized towns

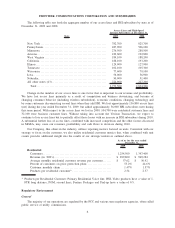

and cities. Revenue was $2.1 billion in 2009. Among the highlights for 2009:

•Verizon Transaction

As previously announced, on May 13, 2009, we entered into an Agreement and Plan of Merger (the

merger agreement), which provides for a merger (the merger) in which New Communications Holdings,

Inc. (Spinco), a newly formed subsidiary of Verizon Communications, Inc. (Verizon) will be merged

into Frontier (the Verizon Transaction). We expect the merger to close during the second quarter of

2010.

The combined company is expected to be the nation’s largest communications services provider focused

on rural areas and small and medium-sized towns and cities, and the nation’s fifth largest incumbent

local exchange carrier, with more than 6.3 million access lines, 8 million voice and broadband

connections and 15,000 employees in 27 states on a pro forma basis as of December 31, 2009. The

combined company will offer voice, data and video services to customers in its expanded geographic

footprint.

Assuming the Verizon Transaction closes, based on the lower level of Spinco debt we will be assuming

from Spinco relative to Spinco’s projected operating cash flows, the combined company’s overall debt

will increase but its capacity to service the debt will be significantly enhanced as compared to Frontier’s

capacity today. At December 31, 2009, Frontier’s net debt to 2009 operating cash flow (“leverage

ratio”) was 3.9 times. It is expected that the combined company’s leverage ratio will be significantly

lower at closing.

•Debt Refinancing

During 2009, we completed two registered offerings of senior unsecured notes for an aggregate $1.2

billion principal amount. The proceeds were used to repurchase approximately $1.1 billion of our long-

term debt, primarily with maturities in 2011 and 2013. As a result of these debt transactions, as of

December 31, 2009, we had reduced our debt maturities through 2013 to approximately $7.2 million

maturing in 2010, $280.0 million maturing in 2011, $180.4 million maturing in 2012, and $709.9

million maturing in 2013. We do not expect the Verizon Transaction to change the amount of these

near-term debt maturities.

•Stockholder Value

During 2009, we continued to pay an annual dividend of $1.00 per common share. In connection with

the Verizon Transaction, we announced that the annual dividend would be reduced to $0.75 per share

upon completion of the Verizon Transaction. Payment of dividends is at the discretion of our Board of

Directors.

•Product Growth

During 2009, we added approximately 56,000 new High-Speed Internet (HSI) subscribers. At December

31, 2009, we had approximately 636,000 HSI customers. We offer a television product with the DISH

3

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES