Frontier Communications 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or stock units. Stock units are awarded under the Directors’ Equity Plan. Directors making a stock unit election

must also elect to convert the units to either common stock (convertible on a one-to-one basis) or cash upon

retirement or death.

The number of shares of common stock authorized for issuance under the Directors’ Equity Plan is

2,540,761, which includes 540,761 shares that were available for grant under the Deferred Fee Plan on the

effective date of the Directors’ Equity Plan. In addition, if and to the extent that any “plan units” outstanding

on May 25, 2006 under the Deferred Fee Plan are forfeited or if any option granted under the Deferred Fee

Plan terminates, expires, or is cancelled or forfeited, without having been fully exercised, shares of common

stock subject to such “plan units” or options cancelled shall become available under the Directors’ Equity Plan.

At December 31, 2009, there were 2,078,989 shares available for grant. There were 11 directors participating in

the Directors’ Plans during all or part of 2009. In 2009, the total options, plan units, and stock earned were 0,

76,326, and 0, respectively. In 2008, the total options, plan units, and stock earned were 0, 102,673, and 0,

respectively. In 2007, the total options, plan units, and stock earned were 10,000, 98,070 and 0, respectively.

Options granted prior to the adoption of the Directors’ Equity Plan were granted under the 2000 EIP. At

December 31, 2009, 182,951 options were outstanding and exercisable under the Director Plans at a weighted

average exercise price of $12.68.

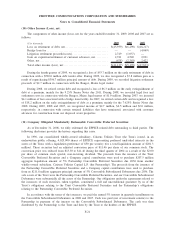

For 2009, each non-employee director received fees of $2,000 for each in-person Board of Directors and

committee meeting attended and $1,000 for each telephone Board and committee meeting attended. The chairs

of the Audit, Compensation, Nominating and Corporate Governance and Retirement Plan Committees were

paid an additional annual fee of $25,000, $20,000, $7,500 and $7,500, respectively. In addition, the Lead

Director, who heads the ad hoc committee of non-employee directors, received an additional annual fee of

$15,000. A director must elect, by December 31 of the preceding year, to receive meeting and other fees in

cash, stock units, or a combination of both. All fees paid to the non-employee directors in 2009 were paid

quarterly. If the director elects stock units, the number of units credited to the director’s account is determined

as follows: the total cash value of the fees payable to the director are divided by 85% of the closing prices of

our common stock on the last business day of the calendar quarter in which the fees or stipends were earned.

Units are credited to the director’s account quarterly.

We account for the Deferred Fee Plan and Directors’ Equity Plan in accordance with ASC Topic 718

(formerly SFAS No. 123R). To the extent directors elect to receive the distribution of their stock unit account

in cash, they are considered liability-based awards. To the extent directors elect to receive the distribution of

their stock unit accounts in common stock, they are considered equity-based awards. Compensation expense for

stock units that are considered equity-based awards is based on the market value of our common stock at the

date of grant. Compensation expense for stock units that are considered liability-based awards is based on the

market value of our common stock at the end of each period.

(14) Income Taxes:

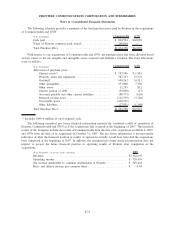

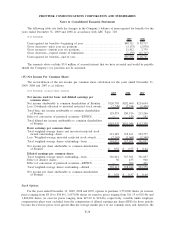

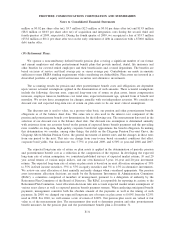

The following is a reconciliation of the provision for income taxes computed at Federal statutory rates to

the effective rates for the years ended December 31, 2009, 2008 and 2007:

2009 2008 2007

Consolidated tax provision at federal statutory rate . ..................... 35.0% 35.0% 35.0%

State income tax provisions, net of federal income tax benefit ........... 2.8 2.8 1.8

Tax reserve adjustment ................................................ — (1.4) 1.0

All other, net.......................................................... (1.6) 0.2 (0.6)

36.2% 36.6% 37.2%

F-25

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements