Frontier Communications 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contingencies

At December 31, 2006, we had a reserve of $8.0 million in connection with a potential environmental

claim in Bangor, Maine. This claim was settled with a payment of $7.625 million plus additional expenses

during the third quarter of 2007.

We currently do not have any contingencies in excess of $5.0 million recorded on our books.

Purchase Price Allocation—Commonwealth and GVN

The allocation of the approximate $1.1 billion paid to the “fair market value” of the assets and liabilities

of Commonwealth is a critical estimate. We finalized our estimate of the fair values assigned to plant, customer

list and goodwill, as more fully described in Notes 3 and 6 to the consolidated financial statements.

Additionally, the estimated expected life of a customer (used to amortize the customer list) is a critical

estimate.

New Accounting Pronouncements

The following new accounting standards were adopted by the Company in 2009 without any material

financial statement impact. All of these standards are more fully described in Note 2 to the consolidated

financial statements.

•Fair Value Measurements (SFAS No. 157, ASC Topic 820), as amended

•Business Combinations (SFAS No. 141R, ASC Topic 805), as amended

•Noncontrolling Interests in Consolidated Financial Statements (SFAS No. 160, ASC Topic 810)

•Determining Whether Instruments Granted in Share-Based Payment Transactions are Participating

Securities (FSP EITF No. 03-6-1, ASC Topic 260)

•Subsequent Events (SFAS No. 165, ASC Topic 855)

•The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting

Principles (SFAS No. 168, ASC Topic 105)

•Employers’ Disclosures about Postretirement Benefit Plan Assets (FSP SFAS No. 132(R)-1, ASC

Topic 715)

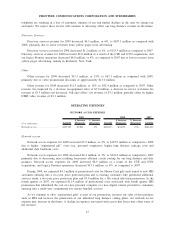

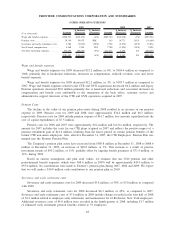

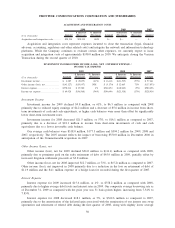

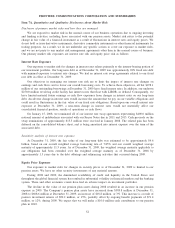

(b) Results of Operations

Our historical results include the results of operations of CTE from the date of its acquisition on March 8,

2007 and of GVN from the date of its acquisition on October 31, 2007. Accordingly, results of operations for

2009, 2008 and 2007 are not directly comparable as 2009 and 2008 results reflect the inclusion of a full year of

operations of CTE and GVN, whereas 2007 results reflect the inclusion of approximately ten months of

operations of CTE and of two months of operations of GVN.

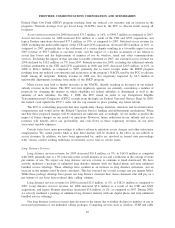

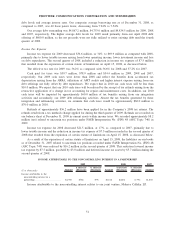

REVENUE

Revenue is generated primarily through the provision of local, network access, long distance, and data and

internet services. Such revenues are generated through either a monthly recurring fee or a fee based on usage at

a tariffed rate and revenue recognition is not dependent upon significant judgments by management, with the

exception of a determination of a provision for uncollectible amounts.

Consolidated revenue for 2009 decreased $119.1 million, or 5%, to $2,117.9 million as compared to 2008.

This decline is a result of lower local services revenue, switched access revenue, long distance services revenue

and subsidy revenue, partially offset by a $31.3 million, or 5%, increase in data and internet services revenue,

each as described in more detail below.

Consolidated revenue for 2008 decreased $51.0 million, or 2%, to $2,237.0 million as compared to 2007.

Excluding additional revenue attributable to the CTE and GVN acquisitions for a full year in 2008 and for a

partial period in 2007, our revenue decreased $107.3 million during 2008, or 5%, as compared to 2007. During

42

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES